Your Cart is Empty

by Hillary Seiler November 19, 2025 15 min read

Let’s be real, money stress is a huge deal, and it doesn’t just disappear when your team clocks in. That's why the whole idea of financial education for employees is blowing up right now. It’s all about giving your people the tools and confidence to manage their finances, and that’s a win for everyone.

It feels like conversations about money are everywhere, and for good reason. Companies are finally waking up to the fact that their employees' financial health directly impacts their performance at work. This isn't just a hunch; it's a reality showing up in productivity levels and team morale.

When someone is worried about making rent or figuring out their student loan payments, they can't bring their full, focused self to their job. That stress follows them from their kitchen table straight to their desk. This is especially true for the younger generations just entering the workforce.

Many young adults are starting their first "real" jobs feeling totally lost about money. They’re often juggling new responsibilities without the foundational knowledge to manage their income effectively.

This lack of preparedness is a widespread issue. Recent data shows that Generation Z, for example, could correctly answer only 38% of basic financial literacy questions. That’s a massive gap, and it highlights a troubling trend as new workers face complex financial choices without the right background.

This isn't just about saving for retirement in 40 years. It’s about dealing with the here and now. The day-to-day pressure of managing expenses, tackling debt, and trying to save for the future can feel completely overwhelming.

The old-school approach of just offering a 401(k) and calling it a day doesn't cut it anymore. Employees need practical, actionable advice for their current financial lives, not just their future ones.

Today's workforce is looking for more than just a paycheck. They want to work for companies that genuinely care about their overall well-being, and that absolutely includes their financial health. Traditional benefits are still important, but there's a clear disconnect between what's offered and what employees actually need.

Think about what people are really dealing with:

This is where a solid financial wellness program in the workplace becomes essential. It’s no longer just a nice-to-have perk; it’s a core component of a modern, supportive benefits package.

By providing real financial education for employees, you show your team that you're invested in their personal success, which in turn builds loyalty and a stronger, more focused workforce.

So, what’s the real payoff for the business when you invest in your team's money skills? It's easy to dismiss financial education for employees as just a "nice-to-have" perk, but that's a huge miscalculation. It's a straight-up business strategy with a clear, measurable return.

Think about it. When your employees are stressed about debt or living paycheck to paycheck, that anxiety doesn't just vanish when they clock in. It follows them to their desk, distracting them from their tasks and making it tough to focus. This isn't just a theory; it's a massive, often invisible, drain on productivity.

The link between someone's personal finances and their professional performance is incredibly direct. When people are worried about making rent or staring down a mountain of student loans, their minds are split. They can't be fully present, creative, or engaged in their work.

This financial stress shows up in concrete ways that hit your bottom line. Anxious employees are more likely to take sick days, not because they're physically ill, but because the mental load is just too heavy. They’re also far less likely to go the extra mile because all their spare energy is being zapped by money worries.

One in three full-time employees says that money worries have negatively impacted their productivity at work. That means a significant chunk of your team could be operating at less than their full potential simply because of financial stress.

You'll probably see a higher turnover rate, too. If an employee feels financially insecure, they're much more likely to jump ship for a job that offers even a slightly higher salary. The cost of recruiting, hiring, and training their replacement is far more expensive than investing in their well-being in the first place.

Now, let’s flip this around. What happens when you offer real, practical financial guidance? It becomes a huge magnet for attracting and keeping great people. It sends a clear signal that you actually care about your team as whole people, not just as cogs in a machine.

Investing in your employees' financial health isn't just a nice gesture. It’s a powerful tool for building a more resilient, focused, and loyal workforce.

Take a look at how financial stress can quietly sabotage a business versus what a solid wellness program can achieve.

| Business Area | Impact of High Financial Stress | Outcome of Financial Wellness Program |

|---|---|---|

| Productivity | Decreased focus and more errors | Increased engagement and sharper focus |

| Retention | Higher employee turnover rates | Improved loyalty and lower attrition |

| Absenteeism | More stress-related sick days | Fewer unscheduled absences |

| Recruitment | Standard benefits package | A competitive edge in attracting top talent |

The "before" and "after" here isn't subtle. One side leads to a cycle of disengagement and high costs, while the other builds a foundation for growth and stability.

The demand for this kind of support is growing fast. A recent Bank of America report revealed that 26% of the American workforce is now looking to their employers for help with things like building emergency savings and reducing debt. That number has doubled in just two years, showing a huge shift in what people expect from their jobs. You can dig into more of these workforce trends in their full report.

Ultimately, providing financial education for employees isn't an expense. It's an investment in your company's most important asset: your people. When they thrive, the business thrives right alongside them.

Alright, you’re sold on the 'why'. Now let's get into the 'what' and 'how'. Building a financial education program that people actually want to use isn't about throwing retirement jargon at them and hoping it sticks. It’s about giving them real-world skills they can use the second a workshop ends.

A great program has to be personal and practical. It should feel less like a stuffy lecture and more like getting solid advice from a friend who’s actually good with money. The goal is to move beyond the standard 401(k) pitch and tackle the stuff that keeps your team up at night.

So, where do you start? The best approach is to cover the financial fundamentals that create a strong foundation. Think of it like building a house. You can't start worrying about the paint colors before you've poured the concrete and put up the walls.

A solid curriculum needs to address the full picture of someone's financial life, from their daily spending to their long-term goals. Here are the non-negotiables your program should cover:

The most effective programs meet people where they are. Someone fresh out of college needs different advice than a manager who is 10 years from retirement. The key is to offer topics that feel relevant to their current life stage.

Once you have the basics down, you can add more specific topics that address other important financial areas. This is where you can really customize the program to fit the unique needs of your team. You can get more insights on building out your curriculum by checking out our guide on creating a financial wellness program for employees.

Think about including sessions on topics like:

The secret to a successful program isn't just the topics you cover; it's how you cover them. You need to make the information personal, relatable, and easy to act on. Forget dry presentations filled with charts and graphs no one understands.

Use real-world examples that people can connect with. Instead of just talking about "debt reduction," share a story about how someone paid off $10,000 in credit card debt in a year. Instead of just defining "compound interest," show them how investing $100 a month can grow into a significant sum over time.

The ultimate goal of financial education for employees is empowerment. You want every person to walk away from a session feeling more confident and in control of their money. When they have practical takeaways they can implement immediately, you've created a program that truly works and makes a lasting difference.

Having amazing content is a great start, but it won’t get you far if nobody actually uses it. The way you get this financial education to your employees is every bit as important as the topics themselves. The goal is to make learning about money feel helpful and accessible, not like another mandatory meeting that everyone dreads.

There’s no single "best" way to do it. The right approach really comes down to your company's vibe, your budget, and how your team prefers to learn. It’s all about finding a mix that fits seamlessly into people's already packed schedules.

Take a minute to think about how your employees operate day-to-day. Are they all in one office, or are they spread out across the country? Do they lean toward quick, digital check-ins or more in-depth, personal conversations? The answers to these questions will point you toward the best delivery models.

For example, a fast-paced tech company with a younger workforce might love a slick, self-paced digital platform. On the other hand, a more traditional company might see much higher engagement from in-person workshops where people feel comfortable asking questions directly.

A flexible approach is your best friend. Combining different methods often works best because it gives everyone a way to engage that feels right for them. One person might love a live webinar, while another prefers confidential one-on-one coaching.

Let's break down the most common ways to deliver a financial education program for your employees. Each one comes with its own set of pros and cons, so it's smart to weigh them against what your company really needs.

Here’s a quick look at the main delivery models to help you figure out which combination might be the best fit for your team.

| Delivery Model | Best For | Pros | Cons |

|---|---|---|---|

| Online Workshops | Engaging distributed teams and covering specific topics in-depth. | Interactive, cost-effective, and easy to record for later viewing. | Can feel impersonal; scheduling can be tricky across time zones. |

| One-on-One Coaching | Providing personalized, confidential guidance for complex situations. | Highly effective and builds trust. | Can be expensive and is difficult to scale for large companies. |

| Digital Platforms | Offering flexible, on-demand learning with tools and resources. | Available 24/7, self-paced, and appeals to tech-savvy employees. | Lacks a personal touch; requires self-motivation from employees. |

This table is a starting point. The real magic happens when you start blending these options to create a program that feels both comprehensive and personal.

The sweet spot is often found by mixing and matching these approaches. You could use a digital platform as the core of your program, offering foundational knowledge and tools that people can access anytime. When you're ready to find the right tools, it's worth exploring the best financial wellness apps and platforms for employee benefits to see what's out there.

Then, you can layer on live online workshops that tackle hot topics like "how to save for a down payment" or offer confidential coaching sessions for those who need more personalized support. As you build out your program, a crucial step is selecting the right Learning Management System (LMS) for HR, which can help you manage and track all these different moving parts.

This blended approach gives you the best of both worlds: the scale and convenience of technology combined with the personal connection and real impact of human interaction. This makes the program feel both accessible and genuinely supportive.

Let's be real, a one-size-fits-all approach to money just doesn't work. The financial advice a 22-year-old new hire needs is worlds away from what a 55-year-old manager planning for retirement wants to hear. This is why tailoring your financial education for employees is a total game-changer.

To make a real impact, you have to meet people exactly where they are on their financial journey. That means ditching generic advice for content that speaks directly to their specific life stage and challenges. It’s all about making the guidance so relevant that they can't help but pay attention.

The goal is simple: the more you customize the advice, the more your team will actually use it and see real benefits. When the information feels like it was made just for them, engagement skyrockets.

In a typical corporate setting, your employees are navigating a unique set of financial opportunities and questions. A solid program for this group has to go beyond budgeting basics and dive into topics directly tied to their careers.

Think about building a curriculum that helps them make the most of their entire compensation package. This means focusing on topics like:

Many employees are also juggling student loan debt while trying to save for retirement. It's a huge balancing act. New IRS guidance on retirement plan withdrawals for student loan payments offers a critical planning option that's incredibly relevant right now.

Professional athletes face a completely different financial reality. They often receive huge sums of money in a very short period, with careers that can be unpredictable and brief. A standard financial education program just won't cut it.

Their financial education needs to be laser-focused on managing large, and sometimes inconsistent, incomes. The curriculum must prepare them for a life after sports, which could last for decades.

For athletes, financial education isn't just about managing wealth; it's about building a foundation for a stable and secure life long after their playing days are over.

Key topics for this group should include:

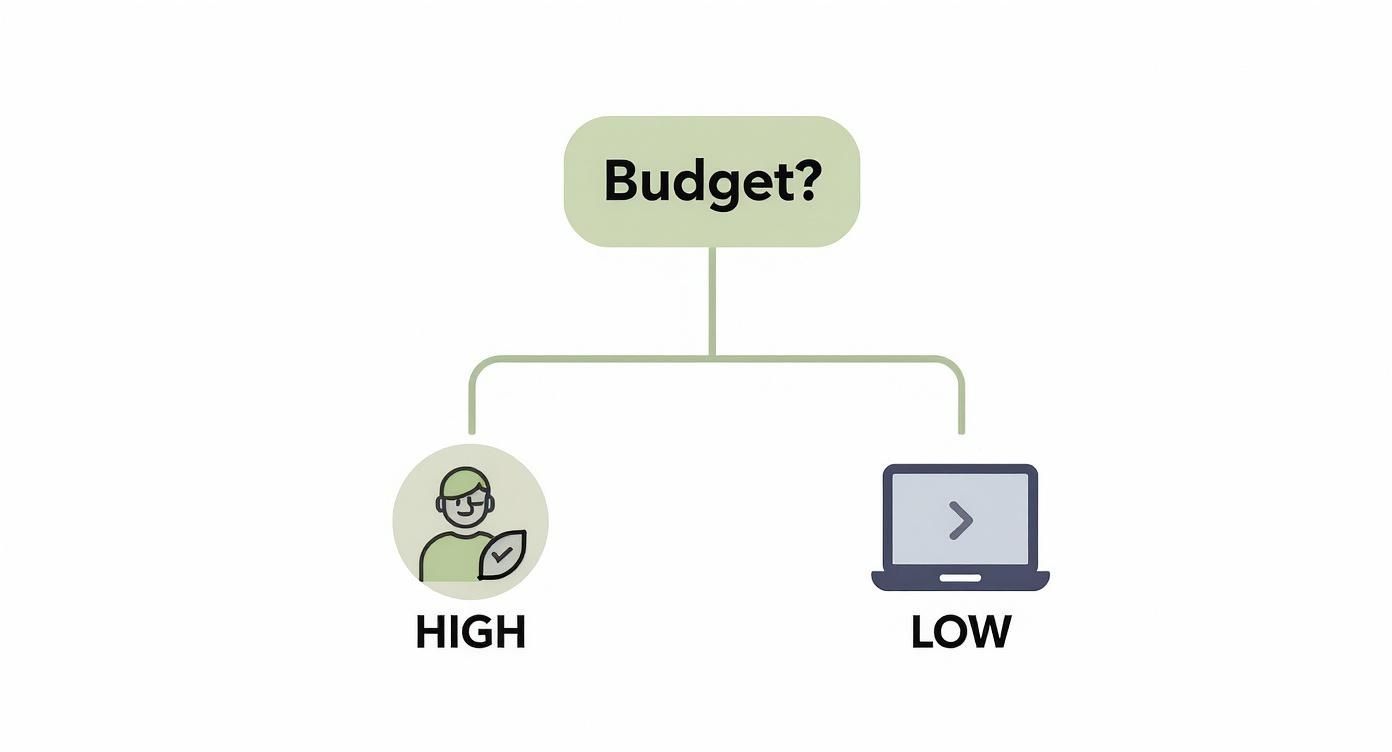

This decision tree shows how you might choose a delivery method based on your company's budget, which is a key part of customizing your approach.

This visual guide simplifies the choice, showing that a high budget can support personalized one-on-one coaching, while a lower budget makes online platforms a more practical starting point.

The world of college sports has been completely turned upside down by Name, Image, and Likeness (NIL) deals. Young student-athletes are suddenly managing significant paychecks for the first time in their lives, often without any financial background.

For this group, the education needs to be foundational and immediate. It’s all about teaching them the absolute basics of personal finance so they can handle this new income without making costly mistakes.

The focus here should be on practical, day-one skills:

By providing this essential knowledge early on, you can set them up for a lifetime of smart financial decisions, whether they go pro or pursue another career path entirely.

So, you're looking into starting a financial education program for your people. It's totally normal to have a few questions swirling around. Let's get right to it and tackle some of the biggest ones leaders ask before they dive in.

Getting these answers straight will help you move forward with confidence, knowing you're making a smart play for both your team and your company.

Figuring out if your program is hitting the mark isn't just a gut feeling. You need to look at a mix of hard numbers and the real-world feedback you get from your team. Both sides of the story are crucial to seeing the whole picture.

On the numbers side, you can track some really clear metrics. A great place to start is with your retirement benefits. Are more people signing up for the 401(k) after you launch the program? Are they bumping up their contribution rates? That’s a huge, immediate win.

You can also look at a few other key indicators:

But don't forget the human side of things. The real goal here is to reduce financial stress. You can use simple, anonymous surveys to get a read on how your employees are feeling. Ask them to rate their money stress on a scale of 1 to 10 before the program, and then check in again six months later.

A drop in self-reported financial stress is a massive victory. When people feel less anxious about money, they are more focused, more present, and more productive at work, which is a direct benefit to the bottom line.

You absolutely don't need a massive budget to make a real difference. If you're working with limited resources, the key is to be strategic and start small. You can build a lot of momentum without a huge spend.

A great first step is to see what you already have. Your company’s retirement plan provider, like Fidelity or Vanguard, probably offers a whole library of free workshops, webinars, and online tools. A lot of companies have these resources but just aren't promoting them. Use them!

Another smart move is to partner with local experts. Reach out to credit unions or non-profit financial counseling organizations in your area. Many of them are happy to come in and host free lunch-and-learns on topics like budgeting or credit scores. It's a win for them because they get community exposure, and it's a win for you because you get expert content for free.

But the single best thing you can do on a tight budget? Just ask your team what they need. Send out a quick, anonymous survey and ask, "What is the one money topic that stresses you out the most?"

Maybe everyone is worried about student loans or saving for a down payment. Focus your initial efforts right there. By solving a real, immediate problem, you'll prove the value of financial education for employees and can build from there as you get more buy-in and resources.

This might be the biggest question of all. You can build the most incredible program in the world, but it's useless if no one shows up. Getting people to participate comes down to making it easy, relevant, and most importantly, private.

First off, you need buy-in from the top. Get your leadership team to talk about the program openly and encourage people to attend. When a manager supports it, it helps break down the stigma around talking about money at work. It signals that this is a supportive benefit, not a lecture.

Communication is also key. Talk about the program everywhere, in emails, on Slack, during team meetings. But always frame it as a benefit designed to help them. This isn't about checking a box for the company; it's about giving them tools for their own lives. Sometimes a small incentive, like a gift card for attending, can give people that extra nudge to sign up.

Most importantly, the program has to feel completely confidential. Money is a deeply personal topic. People will not open up or ask honest questions if they're worried their boss will find out they're in debt.

Using a third-party expert or an outside firm is one of the best ways to create that necessary wall of privacy and trust. When employees know they're talking to a neutral, confidential resource, they're far more likely to engage honestly and get the help they really need.

Ready to empower your team with the financial confidence they need to thrive? Financial Footwork delivers practical, engaging financial wellness education and coaching designed for your employees. Let's work together to reduce stress, boost productivity, and build a more resilient workforce. Learn how we can create a custom program for your company.

Hillary Seiler

Learn MoreCertified Financial Educator, Speaker, Author, & Personal Finance Expert | Helping businesses, pro sports organizations, and universities thrive with Financial Wellness Programs designed to boost growth and success.

by Hillary Seiler February 14, 2026 13 min read

by Hillary Seiler February 12, 2026 16 min read

by Hillary Seiler February 10, 2026 16 min read