Your Cart is Empty

by Hillary Seiler February 14, 2026 13 min read

Let's get straight to it. Your monthly grocery bill is probably one of your biggest and most confusing expenses. It feels like a moving target, right? For the average American family of four, that number lands somewhere between $993 and $1,641 a month, depending on how thrifty or liberal you get with your shopping list.

And it never stays put. Grocery prices jumped 2.4% in 2024, thanks largely to a 3.9% spike in meats, poultry, fish, and eggs, even while dairy dipped by 0.9%. This kind of volatility hits your wallet hard, especially in a market where Walmart controls over 21% of grocery sales and online shopping is changing the game. You can find more insights into these grocery spending statistics if you want to dig deeper.

Ever stare at your receipt and just wonder, "Is this normal?" It's a question we hear all the time. Getting a handle on your spending starts with knowing where you stand compared to others. This isn't about judging your habits. It's about getting a clear picture so you can make smarter moves.

Think of it like checking the scoreboard at a game. You can't figure out your next play until you know the score. Your grocery bill is no different.

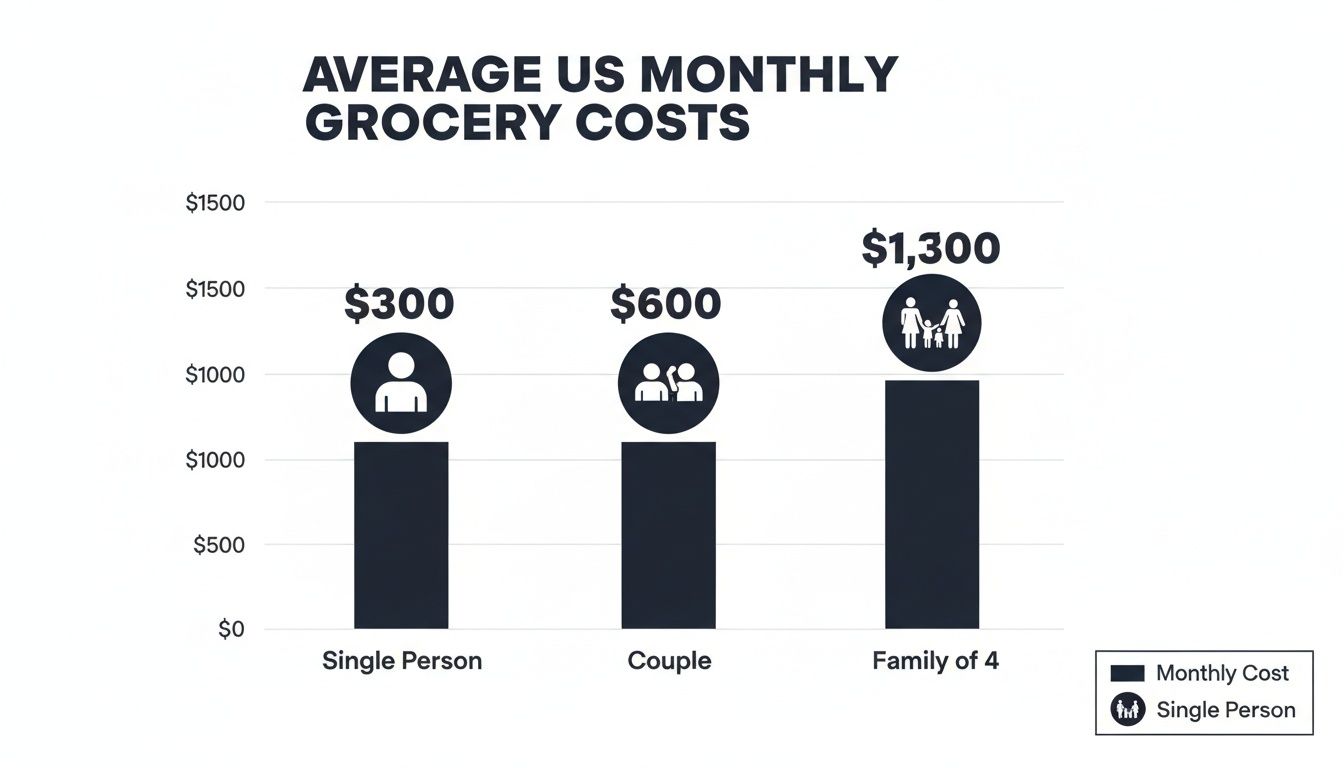

This chart breaks down the average monthly grocery costs by household size, giving you a quick benchmark for a single person all the way up to a family of four.

As you can see, the costs scale up pretty quickly as you add more people to your household, which is exactly what you’d expect.

So, what do the experts say? The USDA actually publishes official food cost plans that serve as a national benchmark. They break it down into a few different spending levels, which is super helpful because no two households have the same budget or lifestyle.

Here’s a look at their four main plans:

To put this in perspective, here's how those USDA plans translate into monthly costs for a reference family of four.

| Food Plan Level | Estimated Monthly Cost |

|---|---|

| Thrifty Plan | $975.70 |

| Low-Cost Plan | $1,180.10 |

| Moderate-Cost Plan | $1,466.80 |

| Liberal Plan | $1,787.20 |

Seeing these numbers laid out gives you a concrete reference point.

The goal isn't to perfectly match one of these plans. Instead, use them as a guidepost. Seeing these numbers helps you understand if your grocery costs are in a typical range or if there’s some room to adjust.

Ever have that moment of sticker shock at the checkout line? You're not alone. It’s rarely one huge purchase that blows up your grocery budget. Instead, it’s usually a collection of smaller, sneakier habits that quietly add up week after week.

Pinpointing these budget busters is the first step toward getting your spending back on track. Some are pretty obvious, like how many mouths you’re feeding or the cost of living in your state. But others are a bit more subtle, like your go-to food choices and how you shop.

What you put in your cart makes a massive difference. If you're all about organic produce, grass-fed meats, or gluten-free everything, you already know those labels come with a higher price tag. These choices aren't inherently bad, but they definitely pack a punch on your bottom line.

For instance, choosing organic isn't just a small price bump. Globally, the organic food market is a massive $230 billion industry in 2024, and it's expected to rocket to nearly $600 billion by 2034. That growth is fueled by huge demand for things like organic meats and yogurt. Understanding trends like this helps explain why your bill climbs when you reach for specialty items. If you want to dive deeper, you can discover more insights about grocery spending statistics to see the full picture.

Of course, it’s not just about organic versus conventional. Here are a few other dietary habits that tend to drive up costs:

It’s not just what you buy. It's how you buy it. Your daily routines and where you live play a huge role in your monthly grocery spending. Think about how often you eat out or grab takeout instead of cooking. Each of those instances adds up and takes a bite out of what you could be saving.

Understanding the bigger economic picture is also key. For example, learning about inflation's impact on grocery prices can shed light on why that box of cereal costs more this month than it did last year.

It's easy to overlook things like "shrinkflation," where the package size gets smaller but the price stays the same. You're paying the same for less product, which is a sneaky price increase that’s easy to miss if you're not paying close attention to unit prices.

Alright, so we've talked about the national averages, but let's get real. Averages are cool for context, but they don't pay your bills. It's time to figure out a personal food budget that actually fits your life, not some random family in a government report.

Creating a budget isn't about restriction. Think of it more like creating a game plan for your money. You wouldn't start a game without knowing the score, right? So, the first step is to figure out what you’re already spending.

Seriously, for the next 30 days, just be a detective. Keep every single receipt from the grocery store, farmers market, or that quick trip for milk. If you mostly use a card, your bank app is your new best friend.

Don’t change a thing about how you shop. The goal isn't to be perfect. It's to get an honest, no-judgment baseline of your current grocery habits. At the end of the month, add it all up. That number, whatever it is, is your starting point.

Now that you have your total, it's time to break it down. Grab your receipts and a highlighter, or open up a spreadsheet if you're feeling fancy. Start sorting your purchases into a few simple categories.

You could organize them like this:

This simple exercise is super revealing. You might find out that 25% of your budget is going to snacks or that you spend way more on fancy coffee than you realized. Seeing the numbers in black and white is the first real step to taking control.

A financial advisor once told me that if you're spending around $200 per person per month on groceries, you're doing great. But that's just a guideline. Your personal budget should reflect what’s realistic for your income and lifestyle.

Okay, you know what you spent and where it went. Now, ask yourself what a reasonable grocery cost per month would look like for you. Don't just slash your current number by half. That's a recipe for failure.

Look at your categories. Where can you make small, easy cuts? Maybe you swap a few name-brand items for store brands or cut back on the pre-packaged snacks. Aim for a 10-15% reduction to start. It’s achievable and builds confidence.

For more guidance on this, check out our article on how to determine the best budget percentages for you. This process is about making intentional choices, not depriving yourself.

To make this even easier, here's a simple template you can use to map things out.

This straightforward table helps you see your last month's spending, set a new goal, and track how you're doing. It’s all about finding that sweet spot between what you want to spend and what you actually spend.

| Category | Amount Spent Last Month | Target Budget | Difference |

|---|---|---|---|

| Produce | $150 | $130 | +$20 |

| Proteins | $200 | $180 | +$20 |

| Pantry Staples | $100 | $90 | +$10 |

| Dairy & Breads | $80 | $70 | +$10 |

| Snacks & Drinks | $120 | $80 | +$40 |

| Household | $50 | $50 | $0 |

| Total | $700 | $600 | +$100 |

Use this template as your guide. Fill in your own numbers, adjust your targets, and see where you can make small changes that add up to big savings over time. It’s your money, and you’re in control.

Alright, let's get to the good stuff, saving money on that monthly grocery bill. Knowing your numbers is one thing, but actually shrinking that total is where the real win is. These are the strategies we share with clients every day, and they’re way more effective than just clipping a few coupons.

It all starts with a plan. Seriously, going into a grocery store without a plan is like trying to build furniture without instructions. You’ll probably end up with something, but it's going to be messy and cost you more time and frustration than it should have.

Meal planning is your number one weapon against overspending. You don't have to map out every single snack and meal for the next month. Just start with dinners for one week. What do you want to eat? What ingredients do you need?

From that simple meal plan, build a shopping list. And here's the hard part. You have to actually stick to it. Every time you wander down an aisle you don't need to be in, you're inviting impulse buys to jump into your cart. Using a shared family tool like the best grocery list app can also keep everyone on the same page and prevent duplicate purchases.

We see it all the time at Financial Footwork. Impulse buys and unplanned trips can inflate that monthly tab by 20-30%. Mastering this one area can free up hundreds for savings or debt payoff, turning grocery runs into wins for your wallet.

Once you're in the store, it's time to shop smarter, not harder. Your phone's calculator is your best friend here. Always look at the unit price, that little number on the shelf tag that tells you the cost per ounce or per item. A bigger box isn't always a better deal.

Here are a few other hacks to put into play:

Finally, let's talk about food waste. Tossing out spoiled food is the same as throwing cash directly into the trash can. Get creative with leftovers, learn to properly store produce so it lasts longer, and do a quick fridge audit before you go shopping to see what you need to use up.

Think of your fridge like a team roster. You want to make sure every player, or food item, gets some time in the game before they expire. Don't let that half-used jar of salsa sit on the bench until it's too late.

By combining these strategies, you can take real control of your grocery spending. For more ideas on getting your finances in order, you might be interested in our guide on how to start saving money.

When your team members are stressed about their grocery bill, that anxiety doesn't just stay in their kitchen. It follows them to work, showing up as distraction, lower productivity, and even burnout.

A rising grocery cost per month is more than a personal problem. It’s a major factor in employee financial wellness.

Think about it this way. If an employee is constantly worried about how they’re going to afford groceries, they aren't fully present. Their focus is split between their work tasks and their financial stress. That mental load is exhausting and directly impacts their ability to perform at their best.

These trends hit employee wellness hard, as rising costs fuel stress and cut into productivity. Financial Footwork's workshops break it down by showing employees how to track a $1,000+ monthly spend, swap pricey organics strategically, and use apps for deals to save 10-20%. You can learn more about food price outlooks and their effects from official USDA findings.

Let’s imagine an employee, Alex. Alex is a solid performer, but lately, they seem a bit off. They’re missing small details and seem less engaged in team meetings.

At home, Alex is trying to manage a grocery budget that feels like it's spiraling out of control.

What started as a small worry is now a constant source of stress. Alex is losing sleep, skipping lunches to save money, and feels completely overwhelmed. That financial strain isn’t just about money. It's about well-being, and it’s affecting their work, relationships, and health.

This is a super common scenario. When a major, non-negotiable expense like food becomes unpredictable, it creates a ripple effect that touches every part of an employee's life, including their job performance. It's a foundational piece of financial stability.

This is where companies can make a huge difference. Generic financial advice just doesn't cut it. You need programs that address the real-world issues your team is facing, like managing their monthly food budget.

By offering practical tools, workshops, and coaching, you can give your employees the skills they need to tackle this major expense. It shows you understand their challenges and are invested in their success, both in and out of the office.

Providing effective resources is a powerful way to reduce stress and build a more focused, engaged workforce. To see how this works in practice, explore our guide on building strong programs for financial wellness for employees. It's about empowering your team to build confidence and take control.

Alright, let's bring this all home. We’ve covered a lot of ground, from figuring out what a "normal" grocery bill even looks like to mapping out your own budget and stocking your playbook with solid saving strategies. This is the final huddle, where we turn all that information into a simple, actionable game plan you can start using today.

The whole point here is to feel empowered, not overwhelmed. You have the knowledge and the tools now. The next move is yours, and it’s all about putting what you’ve learned into practice. It’s time to take control of your grocery spending for good.

Ready to jump in? Here’s a quick checklist of the first three things you can do the second you’re done reading this.

Honestly, nailing your grocery cost per month is a huge confidence booster. When you get this one major expense under control, it creates a positive momentum that spills over into all your other financial goals. You’ve got this.

Still have a few things rattling around in your head? Perfect. Let's tackle some of the most common questions people ask when they're trying to get a handle on their monthly grocery costs.

This is probably the number one question I get, and honestly, there's no single magic number that fits everyone. Most financial pros will point you toward the 10% to 15% range of your take-home pay. That figure usually covers both groceries and any money you spend eating out.

But think of that as a starting point, not a hard rule. If you're a serious foodie, have specific dietary needs, or are feeding a house full of teenagers, your percentage might naturally be higher. On the flip side, if you're a super-frugal solo dweller who loves to cook from scratch, you might land well below that.

The best budget isn't a one-size-fits-all number. It's a realistic plan that helps you hit your financial goals while still enjoying your life. So, start with that 10-15% range, but feel free to tweak it to fit what actually works for you.

It’s been a wild ride with food prices lately, hasn't it? The good news is that things finally seem to be cooling off a bit. On a global scale, food prices have actually been on a downward trend for a few months now.

For instance, the FAO Food Price Index, which keeps a close eye on these things, dipped again in January 2026. That was the fifth monthly drop in a row, putting the index 22.7% below the crazy peak we all felt back in March 2022. This shift is mostly because staples like dairy, meat, and sugar are getting a little cheaper. If you're a numbers person, you can learn more about these global food price findings and see the trends for yourself.

I hear you. Not everyone has the time or patience to become an extreme couponer, and the good news is, you really don’t have to.

The biggest wins come from shifting a few key habits, not from clipping tiny squares of paper. Here are a few strategies that make a much bigger impact on your bottom line:

These simple moves can slash your monthly grocery bill without adding a ton of extra work to your plate.

Ready to take control of your financial game plan? The coaches at Financial Footwork are here to help you build confidence with money, from mastering your grocery budget to planning for the future. Get started with our financial wellness programs today!

Hillary Seiler

Learn MoreCertified Financial Educator, Speaker, Author, & Personal Finance Expert | Helping businesses, pro sports organizations, and universities thrive with Financial Wellness Programs designed to boost growth and success.

by Hillary Seiler February 12, 2026 16 min read

by Hillary Seiler February 10, 2026 16 min read

by Hillary Seiler February 07, 2026 14 min read