Your Cart is Empty

by Hillary Seiler January 10, 2026 16 min read

Feeling crushed by debt is tough, but you can absolutely get out from under it. The key to figuring out how to pay off debt fast isn't some magic trick. It’s about having a solid, actionable plan. Think of this as getting a playbook from a coach who's been there and knows how to win.

Look, nobody enjoys staring at a pile of bills. It’s stressful, and it’s tempting to just shove them in a drawer and hope for the best. But hoping isn't a strategy. The real first step is getting organized and fired up to finally take on your debt.

This isn't about shame or judgment. It’s about taking back control. We’re going to walk through how to face the numbers head-on, so you know exactly what you’re up against. That clarity is about to become your new best friend.

The first move is to get everything out in the open. You can't fight an enemy you can't see. So, grab a notebook or open up a spreadsheet and make a list of every single debt you have.

Seriously, list them all out. Don’t leave anything behind. For each one, you'll want to write down a few key details:

Once you have this list, you've officially created your debt map. It shows you exactly where you are, which is the only way to figure out where you're going. It might feel a little intense seeing it all in one place, but this is a huge win. You've just gone from feeling overwhelmed to being informed.

To kick things off, here's a quick-start table to guide your immediate actions. Think of this as your warm-up lap before the real race begins.

| Action Step | Why It's a Game-Changer | Your First Move Today |

|---|---|---|

| List Every Debt | It replaces vague anxiety with hard facts. You can't make a plan without knowing the full picture. | Grab a notebook or open a spreadsheet. List every balance, APR, and minimum payment. |

| Pick a Payoff Method | It gives your payments a purpose and a direction, turning random efforts into a focused strategy. | Read up on the Snowball and Avalanche methods (we'll cover these next!). Which one feels more motivating to you? |

| Review Your Budget | It shows you exactly where your money is going and helps you find extra cash to throw at your debt. | Look at your last month's bank statement. Where can you find an extra $50 or $100 to accelerate your plan? |

Getting these initial pieces in place builds the foundation for everything that comes next. It’s about creating momentum from day one.

Just making minimum payments feels like running on a treadmill. You’re putting in the effort, but you aren't actually getting anywhere. The numbers show why. In the United States, with average credit card interest rates now over 20%, a small balance can stick around forever.

A $5,000 balance with only minimum payments can take more than 30 years to clear while costing over $10,000 in interest alone. That's insane. But when people commit to a real plan, they often get rid of their debt in just 3 to 5 years. If you want to dive deeper, you can explore how economic factors impact personal debt to understand the bigger picture.

Having a plan is the difference between hoping you’ll be debt-free someday and knowing you’ll be debt-free on a specific date. It turns a vague wish into a concrete goal.

This whole section is about building that initial momentum. Now that you have your list, the next step is choosing your attack strategy. We'll dive into the two most popular methods, the debt snowball and the debt avalanche, to figure out which one clicks with your personality and will keep you motivated for the long haul.

Okay, so you’ve stared your debt in the face and listed everything out. That's a huge step. Now, it's time to choose your attack plan, because just making random extra payments won’t get you where you want to go as fast as possible.

This is where the two heavy hitters of debt payoff come in: the debt snowball and the debt avalanche. Both are awesome, but they work in totally different ways and appeal to different personalities. Figuring out which one clicks with you is key to staying in the game.

Let's talk about the debt snowball first. This method is all about psychology and momentum. If you’re the kind of person who gets fired up by seeing quick progress, this might be your perfect match. It’s less about the math and more about the feeling of accomplishment.

Here’s how it works. You ignore the interest rates for a second and line up all your debts from the smallest balance to the largest. You make minimum payments on everything except for that smallest debt. You throw every extra dollar you can find at that tiny balance until it’s completely gone.

Then, you take the money you were paying on that cleared debt (the minimum payment plus all the extra) and roll it into the next smallest debt. This creates a "snowball" effect. As you knock out each debt, the amount you're throwing at the next one gets bigger and bigger. Seeing balances disappear completely gives you a massive motivational boost.

For a deeper dive into the mechanics and mindset behind this popular strategy, check out our guide on how the debt snowball method can keep you motivated.

On the flip side, we have the debt avalanche. This one is for everyone who loves a good spreadsheet and wants to save the most money possible. The debt avalanche method is purely a numbers game. It’s designed to minimize the amount of interest you pay over the life of your loans.

With this strategy, you list your debts in order of their interest rate (APR), from highest to lowest. You make the minimum payments on all your debts, but you put all your extra cash toward the one with the sky-high interest rate. Once that one is paid off, you take all that payment money and target the debt with the next-highest rate.

This approach will mathematically save you the most money and get you out of debt the fastest. The catch? It can sometimes feel like a slow grind at the beginning, especially if your highest-interest debt also has a huge balance. You might not get that quick win you’d get with the snowball, so it requires a bit more discipline to stick with it.

The best method is the one you’ll actually stick with. Don’t get so caught up in the "perfect" plan that you never start. Whether it’s the thrill of small wins or the satisfaction of saving money, pick the strategy that gets you excited to make that next payment.

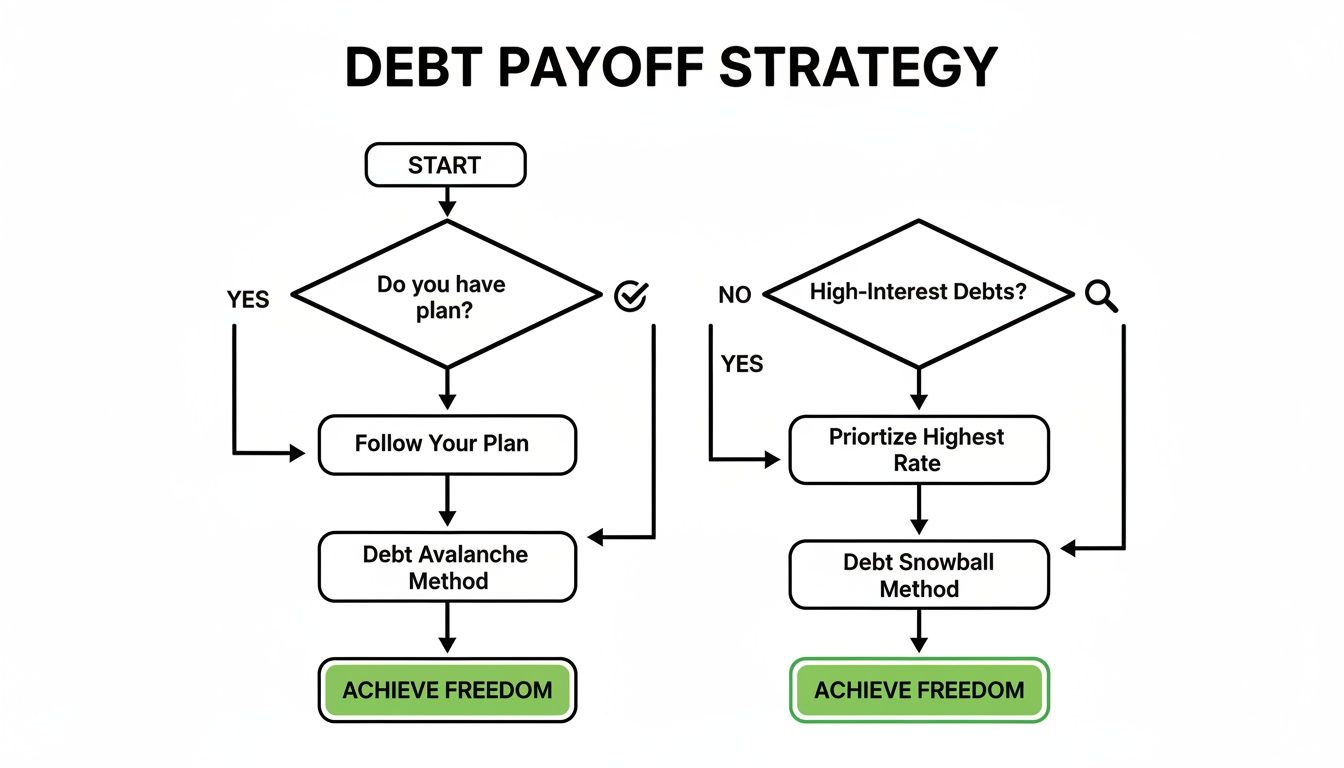

This decision tree gives a simple look at how having a clear plan makes all the difference in your journey to pay off debt fast.

The key takeaway here is that the first step is simply deciding to have a plan, which then leads you down a path of strategic action.

Let's see how this plays out with a real example. Imagine you have these three debts and you've found an extra $200 in your budget to put toward them each month.

Here’s a side-by-side look at how each strategy would tackle this.

| Key Difference | Debt Snowball Example | Debt Avalanche Example |

|---|---|---|

| First Target | The Credit Card because it has the smallest balance ($2,000). | The Credit Card because it has the highest interest rate (22%). In this case, they are the same! |

| Monthly Payment | $250 ($50 min + $200 extra) goes to the credit card. Min payments on the others. | $250 ($50 min + $200 extra) goes to the credit card. Min payments on the others. |

| What Happens Next | Once the credit card is paid off, you'll roll that $250 over to the personal loan, paying $400/month on it. | After the credit card is gone, you'll roll that $250 over to the personal loan (next highest APR), paying $400/month on it. |

In this specific scenario, both methods start with the same debt. However, if the personal loan was only $1,500 but still at 10% APR, the snowball method would have you attack that first, even though the credit card costs you way more in interest. The avalanche would always go after that 22% APR credit card first, no matter the balance.

Ultimately, both paths lead to the same destination: being debt-free. Your job is to pick the one that feels like the smoothest ride for you.

Alright, you’ve picked your debt payoff method. Awesome. Now for the part that actually fuels the whole plan: building a budget.

I know, I know. The word "budget" can sound super restrictive, like you're about to be put on a financial diet of ramen and tap water. But that's not what this is about. A good budget is just a plan for your money, and it’s the absolute key to figuring out how to pay off debt fast.

You can’t get ahead if your money is flying out the door without a plan. The goal here is simple: get a clear picture of where your money is going so you can be intentional about redirecting it toward your debt.

The best budget is one you'll actually use. You don't need a spreadsheet with 50 different categories if that’s not your style. Let’s look at a couple of simple, powerful methods that work for real people.

One of the most popular starting points is the 50/30/20 rule. It’s straightforward and gives you a flexible framework. Here's the basic idea:

The beauty of this method is its simplicity. It gives you permission to spend on things you enjoy while still making serious progress on your financial goals. You can learn more about finding the best budget percentages for you and how to adjust them to fit your specific situation.

If even 50/30/20 feels like too much, try an even simpler approach. Focus only on your "big three" expenses. For most people, the vast majority of their spending falls into just three categories.

Those are typically:

By focusing your attention here, you get the biggest bang for your buck. Trimming just 5-10% from these large categories can free up hundreds of dollars. It's way more effective than trying to cut out a $5 latte here and there.

The point of a budget isn't to track every penny you spend for the rest of your life. It's to get a clear, honest snapshot of your habits so you can make conscious choices that align with your goal of becoming debt-free.

Once you have a handle on where your money is going, it's time for the fun part: finding money to throw at your debt. This is like a treasure hunt, and you might be surprised by what you find.

Start by looking at your "wants." Are there subscriptions you forgot you were paying for? Could you swap a few nights out for cooking at home with friends? This isn't about total deprivation; it's about making trade-offs.

Ask yourself a simple question for each expense: "Is this worth more to me than being debt-free sooner?" Sometimes the answer will be yes, and that’s totally fine. But many times, you'll find things you can easily cut back on without feeling like you're missing out.

Even small changes add up in a big way. Let’s say you find an extra $150 per month. That might not sound like a life-changing amount, but over a year, that’s $1,800 you can put directly toward your debt. On a high-interest credit card, that could save you thousands in interest and shave years off your payoff timeline. It’s all about creating that snowball (or avalanche) effect to accelerate your progress.

Alright, your budget is dialed in and you've picked your payoff plan. Now it’s time to pour some gasoline on the fire.

Finding extra money to throw at your debt is how you really speed things up. This isn't just about skipping your morning latte. We're talking about strategic moves that can free up serious cash. It’s about playing both offense and defense by cutting costs where you can and boosting your income at the same time. You’d be surprised how a few smart adjustments can completely change your timeline.

Before you even think about getting a side hustle, let’s find some cash in your existing expenses. This is often the easiest money you’ll ever find because it doesn’t require working more hours. Sometimes, a single phone call can save you hundreds over the course of a year.

It all starts with a little negotiation. Most companies would much rather give you a small discount than lose you as a customer.

Here are a few places to start:

These calls might take an hour of your time, but they can easily free up $50 to $100 or more each month. That’s cash you can immediately redirect to your debt snowball or avalanche.

If you're battling high-interest credit card debt, refinancing can be a total game-changer. The goal is simple: lower your interest rate so you can stop fighting an uphill battle. You have two main options here.

A balance transfer credit card often comes with a 0% introductory APR for a set period, like 12 to 18 months. You move your high-interest balances to this new card and get a window where your entire payment goes toward the principal. It’s a powerful tool, but be careful. There's usually a transfer fee (around 3-5%), and if you don't pay off the balance before the promo ends, the rate can shoot way up.

A debt consolidation loan is a personal loan you use to pay off all your other debts. This streamlines everything into a single monthly payment, often at a much lower interest rate than your cards. It can make your payments more manageable and predictable.

Think of high-interest debt like trying to swim against a strong current. A balance transfer or consolidation loan is like moving to a calm lake. You’re still doing the swimming, but you'll actually make progress with every stroke.

These options aren't for everyone, and they definitely require discipline. The last thing you want to do is transfer a balance and then run up the old cards again. But used correctly, they can save you a ton in interest and seriously accelerate your payoff timeline.

Now for the fun part: making more money. Even an extra few hundred dollars a month can make a massive difference in how fast you get out of debt. The key is to find something that fits your schedule and skills without burning you out completely.

Don't overthink it. Your side hustle doesn't have to be some grand passion project or a new career path. For now, its only job is to bring in extra cash for a season.

Another great way to find a chunk of money is with your tax refund. Instead of seeing it as bonus money for a vacation, think of it as a golden opportunity to knock out a huge piece of your debt. If you're looking for ideas, there are plenty of smart ways to spend your tax refund that can launch you closer to your goal. To significantly boost the funds available for debt repayment, you can also explore advanced strategies to legally cut your tax rate, potentially freeing up substantial income. Finding more money is the secret weapon for anyone wondering how to pay off debt fast.

We’ve been deep in the trenches of payoff plans and budgets, so let's zoom out for a minute and talk about the big picture. Why is getting out of debt such a game-changer anyway?

When you hear things like inflation or interest rates on the news, it can feel disconnected from your daily life. But it's not. Those numbers directly impact how much your loans cost and how far your paycheck actually goes.

Paying off your debt, especially the high-interest kind, is like building your own personal financial shield. You become far less vulnerable to whatever the economy decides to throw your way.

Think about it. When you owe less money, a surprise car repair or a cut in your work hours is a problem, not a full-blown crisis. You suddenly have breathing room. You’re no longer one unexpected bill away from having to take on even more debt just to stay afloat.

This isn't just about numbers on a spreadsheet; it’s about dialing down the stress. That constant, low-grade anxiety that comes with owing money? It starts to fade. That alone is a massive win for your mental health.

Getting out of debt gives you the power to make life choices based on what you want, not what you owe. It’s the ultimate form of financial freedom.

This becomes even more critical when you look at the wider economic landscape. The Institute of International Finance tracks global debt, and the numbers are staggering. A high-debt environment often means higher interest rates and a more volatile job market for regular people. For employees carrying 15–25% in consumer debt, this environment makes them incredibly vulnerable.

Ultimately, becoming debt-free is about creating options for your future. It means you can finally start thinking about your bigger goals without that weight on your shoulders.

This isn’t just a financial task to check off a list. It’s a huge step toward building a life on your own terms. Beyond just getting out of the red, becoming debt-free lays the groundwork to help you cultivate long-term financial security. It’s about giving your future self the best possible shot at success and stability.

As you start knocking down your debt, questions are bound to pop up. It's a totally normal part of the process. Here are some of the most common ones we hear from people, along with straightforward answers from our coaches to keep you on track.

This is a fantastic question, and the honest answer is: it depends on your interest rates. It really boils down to a simple math problem that compares your debt's interest rate to the return you could realistically expect from investing.

If you're staring down high-interest debt, like a credit card with a 20% APR, paying it off is like getting a guaranteed 20% return on your money. You simply can't beat that in the stock market. For that kind of debt, it almost always makes sense to press pause on investing and go on the attack.

The one major exception is a 401(k) match from your employer. You should always contribute enough to get the full match. It’s literally free money, and passing that up is nearly impossible to justify. For lower-interest debt, like a mortgage under 6%, it can make a lot more sense to keep investing while you pay it down on schedule.

Hands down, the biggest mistake we see is not having a small emergency fund in place before going all-in on debt repayment. It sounds backward, I know, but it’s critical.

People get so fired up to start their debt-free journey that they throw every single extra dollar at their loans. Then, a small, unexpected emergency hits, like a flat tire or a surprise vet bill. With no cash cushion, they have no choice but to swipe a credit card.

It's incredibly discouraging and feels like taking one step forward only to be knocked two steps back. Building a small buffer of even $500 to $1,000 first can break this cycle and keep your momentum going strong.

The second biggest mistake? Making a budget that’s way too strict. If you create a plan with zero room for any fun whatsoever, you're just setting yourself up for burnout. A realistic plan you can actually stick with for the long haul will always win.

This one is completely unique to you. It depends on three key things: your total debt, your income, and how aggressively you can make extra payments. There’s no magic number that fits everyone.

But what we can tell you is this: for unsecured debt like credit cards and personal loans, people using a focused plan like the snowball or avalanche method often become completely debt-free in 3 to 5 years.

The absolute best way to get a clear timeline for your own situation is to use an online debt payoff calculator. You can plug in all your debts, figure out how much extra you can realistically throw at them each month, and it will spit out your debt-free date.

Seeing that finish line can be a massive motivator. It turns a vague goal into a concrete target and keeps you going when things get tough. Knowing the end is in sight makes all the hard work feel worth it.

Ready to build a real plan for your financial future? At Financial Footwork, our coaches are experts at helping you create a strategy to get out of debt and build lasting confidence with your money. Learn more about our programs at https://financialfootwork.com.

Hillary Seiler

Learn MoreCertified Financial Educator, Speaker, Author, & Personal Finance Expert | Helping businesses, pro sports organizations, and universities thrive with Financial Wellness Programs designed to boost growth and success.

by Hillary Seiler February 25, 2026 4 min read

Read More

by Hillary Seiler February 14, 2026 13 min read

by Hillary Seiler February 12, 2026 16 min read