Your Cart is Empty

by Hillary Seiler December 22, 2025 15 min read

Financial literacy for employees is all about giving your team the skills and confidence to make smart money decisions. Think of it as a core workplace benefit designed to dial down financial stress, which in turn ramps up focus, productivity, and loyalty.

Basically, it’s an investment in your people's total well-being.

Let’s be real, a lot of your employees are stressed about money, and that anxiety doesn’t just disappear when they clock in. It follows them to their desks, onto the factory floor, and into meetings.

This is exactly why financial literacy for employees is quickly shifting from a nice little perk to a fundamental business strategy. This isn’t just about being a good employer, it’s about directly tackling a massive drain on your company's productivity.

When people are worried about debt or how they'll cover an unexpected bill, their focus at work suffers. It’s that simple.

The numbers paint a pretty clear picture. A huge chunk of the workforce spends hours each week at their job thinking about personal finance issues. All that lost time adds up, impacting everything from project deadlines to overall team morale.

This financial strain isn't just a vague feeling of worry. It shows up in concrete ways that hit your bottom line:

The reality is, a financially stressed employee is an unproductive one. Providing the tools to manage that stress is one of the most direct ways to support both your team's well-being and your company's performance.

Supporting your team's financial health sends a powerful message: you care about them as whole people, not just as workers. This is especially true for younger teams, like Gen Z and millennials, who are actively looking for employers that invest in their total well-being.

The data on this is staggering. Recent findings show that U.S. adults, on average, get only 49% of personal finance questions right, a number that has barely budged in years. This knowledge gap is even wider for women, Black and Hispanic Americans, and Gen Z.

Low-literacy workers are twice as likely to be stuck in debt and often spend 10 hours a week dealing with money issues, compared to just five hours for their more confident peers. You can check out more stats and dive into the full 2025 P-Fin Index report to see the complete breakdown.

By providing strong financial education for employees, you give them the confidence to build a more stable future. For a deeper look at the importance of improving employee financial well-being, explore these insights on achieving financial excellence.

This builds a deep sense of loyalty that a small pay bump just can't compete with.

Let's be honest, a great program is one people actually want to show up for. So, how do you pull that off? It all comes down to designing a financial literacy program that speaks to your employees' real-life money questions and stressors.

A one-size-fits-all approach is pretty much guaranteed to fail. The key is creating something that feels immediately relevant and accessible, not just another mandatory corporate training they have to click through.

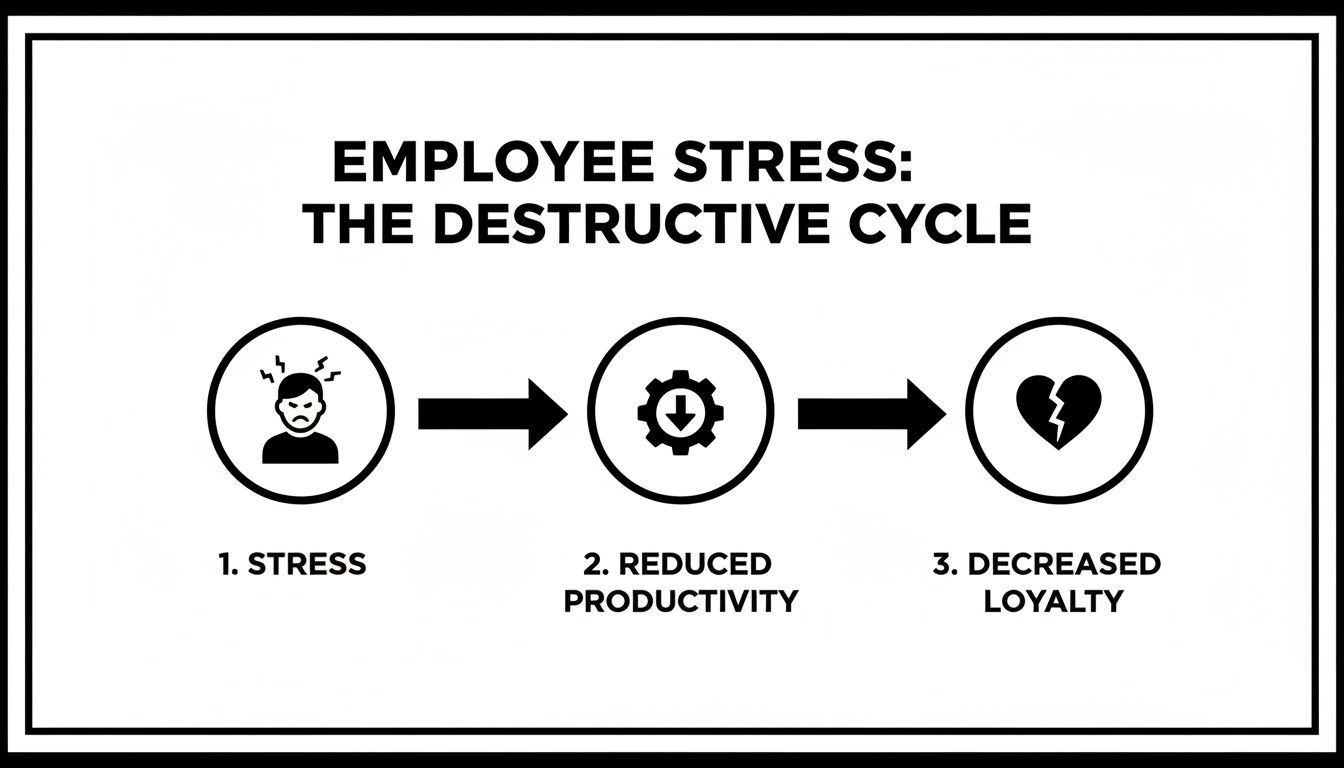

The ripple effect of financial stress on work is undeniable. It starts with personal anxiety, which quickly bleeds into decreased productivity and, eventually, impacts team loyalty and retention.

This simple flow shows that by tackling the root cause, which is financial stress, you can directly improve both productivity and retention.

To get people in the door (or on the Zoom call), you have to talk about what’s actually on their minds. An anonymous survey is the perfect way to start. Just ask what topics they’d find most valuable.

You might discover your younger team members are losing sleep over student loans, while those a bit older are wondering how they’ll ever save for a house.

Here are a few topic ideas to get the ball rolling:

The goal is to provide practical, actionable advice that someone can put to use the very next day. When you're putting it all together, remember that incorporating adult learning principles is the secret to creating engaging and effective content that truly sticks with your team.

How you deliver the information is just as important as the information itself. Different formats click with different company cultures and learning styles, so there’s no single right answer here. Mixing it up is often the best strategy.

Think of your program delivery like a playlist. You need different vibes for different moods. A high-energy workshop is great for kicking things off, but quiet, one-on-one sessions are where people can really open up and get personal.

Let's break down some of the most popular and effective options.

Here's a quick comparison to help you decide which delivery method fits your company culture and employee needs best.

| Format Type | Best For | Potential Drawbacks |

|---|---|---|

| Workshops & Lunch-and-Learns | Foundational topics like budgeting, understanding benefits, or retirement basics. | Can be hard for people to ask sensitive or personal questions in front of their coworkers. |

| One-on-One Financial Coaching | Deep dives into personal debt, creating a custom financial plan, or navigating a major life event. | Can be more resource-intensive to offer, but offers the highest ROI on employee trust and progress. |

| Digital Tools & Platforms | On-demand learning, tracking progress, and providing continuous support between live sessions. | Lacks the human connection and personalized accountability of live coaching. |

Each of these formats has its place, and a truly comprehensive program will likely use a mix of all three. Let's look a little closer at each one.

These are perfect for introducing broad topics in a low-pressure group setting. They're fantastic for building a sense of community and showing people they aren't alone in their financial questions.

This is where the real magic happens. Confidential sessions with a financial coach give employees a safe space to talk about their specific situation without fear of judgment. It’s the most personalized and impactful format you can offer.

Modern problems often need modern solutions. Providing access to digital resources allows employees to learn at their own pace. You can find tons of great financial wellness apps and platforms for employee benefits that offer everything from budgeting tools to educational articles and videos.

Ultimately, the best approach is often a blend. You can use workshops to generate buzz and cover the basics, then offer one-on-one coaching for personalized support and digital tools for ongoing learning. This creates a complete support system that meets people wherever they are on their financial journey.

So, what should you actually teach your team? This is where the rubber meets the road. Building a solid curriculum is all about ditching the fluff and focusing on the real money questions that keep people up at night.

This isn't about turning your employees into Wall Street pros. It's about giving them the confidence and practical tools to make smart money moves in their everyday lives. A great financial literacy for employees program feels less like a lecture and more like a helpful, honest conversation.

Before anyone can even think about investing or saving for big goals, they need a solid foundation. These are the topics that apply to literally every single person on your team, no matter their age or income. Think of these as the non-negotiable starting points.

You’d be surprised how many people, even high earners, have never been taught the basics. In fact, a recent survey showed that 56% of employees spend three or more hours at work each week stressing about their finances. Covering these fundamentals can immediately help lower that number.

Your foundational curriculum should definitely include:

These topics provide immediate value and build the confidence your employees need to tackle more complex subjects later on.

Once the basics are covered, it's time to get into the topics that cause the most anxiety. This is where your program can make a massive difference in people's lives. Remember that anonymous survey we talked about? Use that feedback to prioritize what comes next.

Chances are, these big-ticket items will be at the top of the list.

The most impactful financial training doesn't just present information. It provides a clear path forward on the exact issues that feel overwhelming, like student debt or saving for retirement. It's about replacing fear with a plan.

For example, a staggering 57% of working Americans feel behind on their retirement savings. Addressing this head-on is a huge win for your program. You can find out more about how to structure these sessions in our guide on employee financial training.

Here are a couple of sample outlines to show you what this could look like in practice.

By focusing your curriculum on these practical, real-world topics, you create a program that doesn't just educate. It empowers.

You’ve designed a killer program with a curriculum that’s going to make a real difference. Now for the make-or-break moment, getting people hyped enough to actually sign up. This is your launch playbook, and it’s all about building buzz without sounding like a corporate robot.

The goal here is to make your financial wellness program feel less like a mandatory meeting and more like an exclusive opportunity. We need to craft a message that cuts through the noise of daily emails and deadlines, making enrollment a total no-brainer.

This isn’t just another line item on the benefits list. It's a direct investment in your people's personal growth, and your launch communication needs to have that same energy.

Forget the generic, buttoned-up announcements. If you want people on board, you have to meet them where they are. That means using the channels they actually pay attention to and speaking their language.

A multi-channel approach is your best bet. Don't just fire off one email and call it a day. The key is to build a steady drumbeat of excitement leading up to the launch.

Here are a few tactics that I’ve seen work wonders:

This initial communication is also the perfect time to tackle a major barrier head-on, the awkwardness around talking about money.

The secret to getting past the money taboo is to scream confidentiality and non-judgment from the rooftops. Make it crystal clear in every single message that this is a safe space for personal growth, not a place for shame or comparison.

When you launch your program can be just as important as how you launch it. You want to catch people at moments when finances are already top of mind. This kind of strategic timing can give your enrollment numbers a serious boost.

Think about the natural cycles of your work year. Are there specific times when your team is already thinking about their pay, benefits, and future goals?

A few prime opportunities include:

Right now, getting this support in place is more critical than ever. Recent data shows that in 2025, financial inclusion scores actually declined in many global markets as economic uncertainty grew. But here’s the thing, employers are still the number one institution people trust for financial support, with 67% of workers feeling this way. Simple actions like providing clear benefits info and digital tools can rebuild that trust and make a massive difference in your team's confidence. You can discover more insights about the global focus on financial security and what it means for your workplace.

By launching at the right moment, you're not trying to create a new conversation from scratch. You're joining one that's already happening, making your program feel timely and incredibly relevant.

Okay, so you’ve designed and launched an incredible program. Now for the hard part: proving it works. To keep the program going, and let’s be honest, to keep it funded, you have to show it’s making a real difference. This is where we move beyond simply counting how many people showed up for a workshop and get into the metrics that actually matter.

Proving the return on investment isn't just about crunching numbers for the leadership team. It's about telling the story of how better financial literacy for employees is creating a stronger, more stable workforce.

Headcount is a start, but it’s a vanity metric. Sure, it’s great to know people are interested, but it tells you nothing about whether they learned something or changed their behavior. To see the real impact, you have to dig deeper.

The best approach is to blend qualitative feedback with hard data. This combination gives you the full picture, showing both the human impact and the bottom-line business benefits.

Anonymous surveys are your best friend here. They allow you to measure shifts in attitude, stress, and understanding without putting anyone on the spot. The key is to run them before the program kicks off and again a few months after it ends.

This pre- and post-program method gives you clear, undeniable before-and-after data.

Here are a few things you should be asking:

Watching these scores improve over time is powerful proof that your program is landing. It shows people aren't just attending; they're internalizing the information and gaining real confidence.

This is where you connect the dots between your program and tangible business outcomes. By looking at company-wide data, you can spot trends that point to a positive shift in financial behavior across the entire organization. This is the kind of data that leadership loves to see.

Partner with your HR and benefits teams to pull these key numbers.

Showing a 5% increase in 401(k) participation or a drop in hardship withdrawal requests is infinitely more powerful than saying "people liked the workshop." It translates your program's impact into the language of business results.

A few key metrics to keep an eye on:

Don't just collect this data, visualize it. A simple dashboard is the perfect way to share your progress with stakeholders and give them a quick, clear snapshot of the program's success.

Here's a sample of what that could look like:

| Metric | Baseline (Pre-Program) | Current (Post-Program) | Goal |

|---|---|---|---|

| Average Financial Confidence Score (1-5) | 2.8 | 4.1 | 4.0+ |

| 401(k) Participation Rate | 65% | 72% | 75% |

| Employees Contributing Up to the Match | 80% | 88% | 90% |

| Financial Stress Score (1-5) | 4.2 | 3.1 | Below 3.5 |

This kind of dashboard tells a compelling story at a glance. It proves that your investment in employee financial wellness isn't just a "nice-to-have" initiative. It’s a strategic move that directly boosts employee security, engagement, and the company's overall health.

Even with a solid plan, you're probably wrestling with a few "what ifs." That's completely normal. Let's dig into some of the most common questions HR and benefits leaders ask when they're getting a program like this off the ground.

Getting the right answers upfront can make the whole process feel way less daunting.

Finding the right person to lead your sessions is everything. You need someone who knows their stuff but also has the right vibe to connect with your team. A great place to start is looking for Certified Financial Planners (CFPs) who have experience working with companies on their wellness programs, not just individual clients.

You can also team up with specialized companies that provide already-vetted financial coaches. The most important thing is finding someone relatable who can create a safe, non-judgmental space for your people.

The goal here is pure education, not sales. You absolutely want to avoid anyone who might be trying to push financial products. That's a huge red flag and will completely kill the trust you're trying to build.

The absolute biggest mistake you can make is treating your program like a one-and-done event. Real financial confidence isn't built in a single training session. It’s much better to think of it as starting an ongoing conversation with your employees.

A single workshop is a fantastic start, but true, lasting change comes from continuous support and reinforcement. This means providing different ways for people to engage over time.

You have to keep the momentum going by offering things like:

When you do this, you show that financial wellness is a real, integrated part of your company culture, not just a box you checked.

This is a big one. It's natural for people to feel a little weird or private about their money. To get past that, you have to hammer home confidentiality right from the start and repeat it in all of your communications.

Using anonymous surveys to gather topic ideas is another great tactic. It makes people feel heard without forcing them to attach their name to a specific money struggle.

It can also be incredibly powerful to have senior leaders share their own financial learning journey. Hearing a manager talk about a money mistake they made or a goal they're working toward makes the whole topic feel more normal and way less intimidating. Just be sure to frame the program as a cool benefit for personal growth, not some kind of remedial class. That small shift in language helps get rid of any potential stigma.

Ready to build a program that reduces stress and boosts your team's confidence? Financial Footwork delivers engaging financial wellness education and coaching designed for the real world. Let our expert coaches help your employees make confident money moves. Get started with Financial Footwork today.

Hillary Seiler

Learn MoreCertified Financial Educator, Speaker, Author, & Personal Finance Expert | Helping businesses, pro sports organizations, and universities thrive with Financial Wellness Programs designed to boost growth and success.

by Hillary Seiler February 10, 2026 16 min read

by Hillary Seiler February 07, 2026 14 min read

by Hillary Seiler February 04, 2026 15 min read