Your Cart is Empty

by Hillary Seiler January 06, 2026 15 min read

Snagging your employer’s full 401(k) match is basically free money. If you set your deferral rate at least to the match threshold and spread it out evenly, you’ll make sure every dollar you put in gets matched. Pair that with simple tracking habits and steady pacing, and you won’t leave a penny on the table.

Okay, first things first: hop into your 401(k) portal and check your current deferral percentage. Try to hit at least your plan’s match threshold, so every dollar up to that point earns that sweet employer contribution.

It’s tempting to ramp up contributions in December, but spreading them out avoids surprises, and gaps in your match.

Before diving in, here’s a quick reference:

Key 401k Match Strategies Summary

| Strategy | Action | Benefit |

|---|---|---|

| Match Formula Review | Chart your employer’s tiers and caps | Pinpoint exactly how much you need to contribute |

| Paced Contributions | Distribute your deferral evenly each payday | Prevent year-end shortfalls and lost matching dollars |

| Tax Mix Balance | Allocate funds between pre-tax and Roth | Combine immediate tax savings with future tax-free growth |

Keep this table handy so you can stay on track.

If you want to buff up your money skills, check out our guide on financial education for employees for more tips on capturing employer match.

Consistency beats last-minute fixes. Pick a date each payday to:

Make sure your match is locked in by verifying contributions every other paycheck.

Using a simple spreadsheet or note app lets you spot shortfalls before December rolls around. Update it each pay run and look out for:

If you’re into tax diversification, you can split some of your deferrals into Roth, but not if it means missing that match threshold first.

Cranking up your deferral at the end of the year can accidentally hit contribution caps and leave match opportunities on the table. If you pace your contributions, your employer’s match formula works smoothly each payday.

With these habits in place, you’ll confidently log in this pay period and lock in your full employer match, no surprises, no regrets.

Figuring out exactly how your employer calculates its 401(k) match can unlock savings you didn’t even know were there. Break down the math, and it’s easy to grab every dollar of free money.

Most plans follow one of two patterns: single-tier or tiered matching. Single-tier means one flat rate on all deferrals, while tiered gives you a higher rate up front and then tapers off after hitting certain thresholds.

| Formula Type | Description | Real-World Example |

|---|---|---|

| Single-Tier | Single match rate on all deferrals | 100% match up to 4% of pay |

| Tiered | Varying rates at different levels | 100% on first 3%, then 2% on next contribution |

With a flat match, it’s pretty clear. If your plan offers a 100% match up to 4%, just set your contributions there.

Tiered matches feel super generous at first. For example, a 50% match on the first 6% of salary gives you 3% of pay in free money. After that, the rate drops.

Getting the tiers down stops you from overestimating what your employer will chip in.

Don’t leave generous matches on the table just because the structure seemed confusing.

Seeing side-by-side examples clears things up:

| Match Rate | Deferral Limit | Match Value on $100,000 Salary |

|---|---|---|

| 50% up to 6% | 6% | $3,000 |

| 100% up to 4% | 4% | $4,000 |

On a $100,000 salary, a 100% match up to 4% adds $4,000 of free money every year.

Your employer match follows vesting rules before it becomes truly yours. Common schedules include:

Check your vesting timeline before making a career move, or you might lose unvested funds if you leave early.

In the U.S., employer matches usually range from 4% to 6% of pay. Surveys show an average contribution around 4.6% to 4.8% of salary. For a $100,000 earner, maxing a 4.6% match nets $4,600 each year. And at a 6% annual return over 30 years, that could grow to about $523,000 in nominal value. Learn more on Kiplinger.

You don’t need a fancy tool to turn percentages into real savings. Here’s a quick way to figure out your match:

Take an $80,000 salary with a 50% match up to 6%:

That simple calculation hands you your annual match. Whenever your pay changes, rerun the formula so you never guess.

Turning percentages into dollars makes sure you grab every bit of employer match.

Your plan document holds the fine print that really matters:

Sarah earns $75,000 and her employer does a 50% match on the first 6%. She does the math:

By setting her contribution at 6% and checking her portal each month, Sarah captures the full $2,250 of free money without missing a beat.

A quarterly check, whether that’s a spreadsheet or a note-taking app, keeps her on track. She even uses the plan’s calculator as a mid-year sanity check. Staying proactive with these simple steps means no missed contributions and max match every time.

Pacing your 401(k) contributions throughout the year beats scrambling to max out in December. Align each paycheck with your employer’s match formula, and you’ll avoid end-of-year surprises and keep your retirement savings humming.

Picture a monthly payroll plan that applies a match on every check. You stay under IRS deferral limits, spread your savings out, and make monitoring easier so no match slips through the cracks.

Vesting rules decide how much of your employer’s contributions you actually own. With cliff vesting, you own nothing until you hit a milestone, then bam, you get 100% of those funds. Graded vesting gives you a piece of the match each year.

Most plans calculate matches on each payroll and then apply vesting over time, anywhere from immediate vesting to a graded schedule spanning three to six years. For instance, a 50% match up to 6% of pay on an $80,000 salary delivers $2,400 annually. On a four-year graded vesting plan, leaving after two years means you keep only half of that match, forfeiting the rest. Learn more about 401k plan benchmarking at blog.ifebp.org

Vesting milestones can cost you thousands if you move on before you unlock 100% of those match contributions.

Mapping your pay schedule into a visual timeline makes it easy to time your contributions. Check out this simple monthly flow for a single-tier match plan.

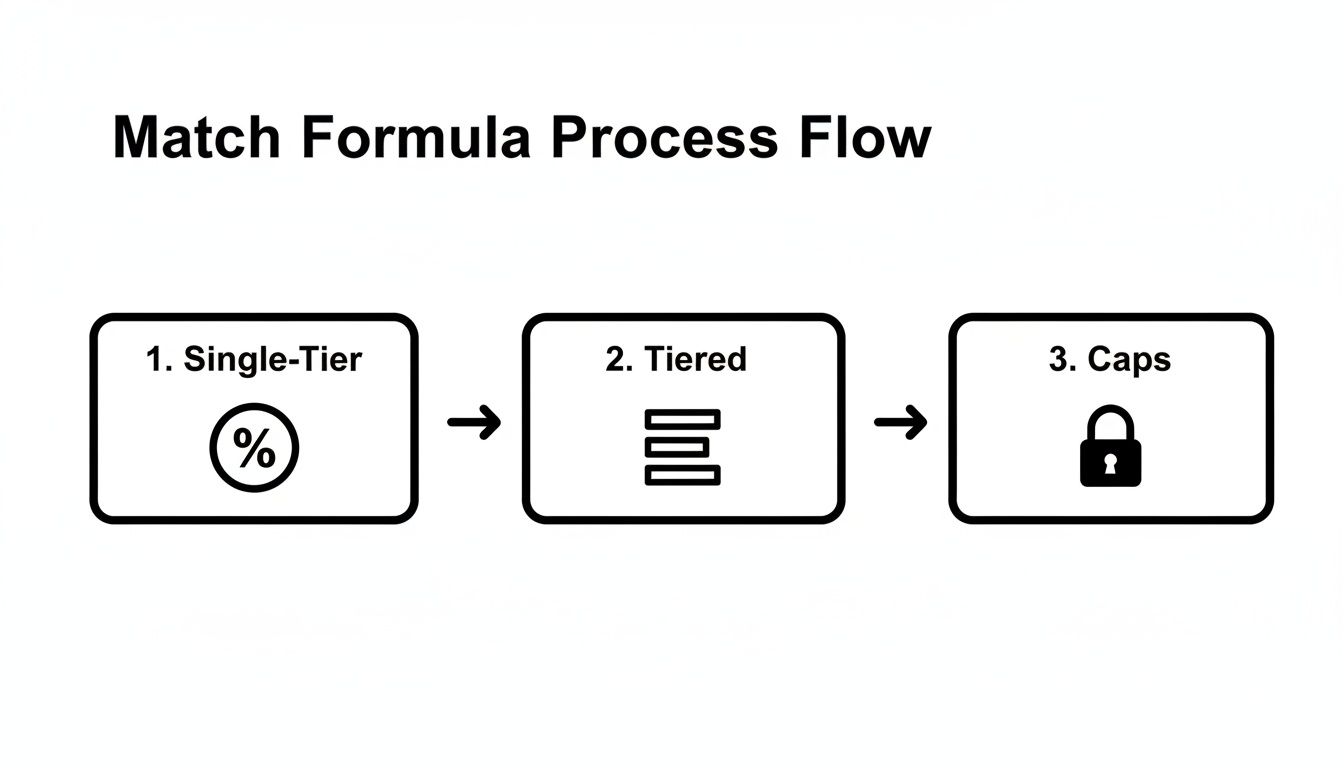

Use this infographic to see how single-tier, tiered, and cap formulas drive match momentum. Then before each payday:

Switching employers can trim your match balance if you aren’t fully vested. A bit of strategic timing can protect those free dollars.

For more basic saving strategies, check out our guide How To Start Saving Money

A few tweaks in your contribution timing and vesting strategy can net you thousands in extra match dollars.

Putting just 1% more of your paycheck into your 401(k) adds up fast. On a $70,000 salary, that’s an extra $700 each year. With a 50% match, you pocket another $350 in free employer money annually.

Keep up that shift for ten years and, assuming a 6% compound return, you could see $6,000 more over a decade.

Mix smart timing with vesting know-how and you’ll snag every dollar you and your employer put in. Plan contributions just before pay dates, map your vesting milestones, and watch those match dollars stack up.

Irregular income like commissions or bonuses needs special attention. Spread bonus deferrals over remaining paychecks to snag every possible match.

A quick mid-year check stops missed opportunities and keeps your vesting on track. Take action now to maximize your employer 401(k) match.

Keeping your 401(k) match humming means watching both IRS rules and your plan’s ceilings. In 2025, the elective deferral limit is $23,500 for those under 50, and total contributions can’t exceed $70,000. On average, employees pitch in around 9.5% of pay and employers match about 4.8%. To never lose out, track IRS and plan compensation caps each pay period and tweak your deferral rate on the fly. Read the full research about average match rates on Fidelity.com

A quick glance at your YTD numbers can save you from surprise cut-offs late in December.

Before each paycheck lands, run this mini-audit:

Keep a small notebook or spreadsheet—it takes seconds to update, and it’s a lifesaver when totals creep up.

If you’re on a biweekly schedule with 26 paychecks, front-loading is a real risk. On a $120,000 salary, 9.5% deferrals are about $11,400 annually. Splitting contributions evenly avoids match gaps.

| Item | IRS Limit | Plan Cap | Paychecks Left |

|---|---|---|---|

| Elective Deferral YTD | $23,500 | N/A | 26 |

| Total Contributions YTD (Est) | N/A | $70,000 | 26 |

When you near either ceiling, dial back your rate or shift extra dollars into a taxable account.

Got a $10,000 bonus? These quick checks help you snag every match dollar:

For instance, if you’ve already set aside $18,000, you’ve got $5,500 left. Deferring 55% of your bonus captures it all without overshooting.

Pro tip: Drop a note in your payroll portal or email HR when you tweak your rate for a bonus—small communication, big peace of mind.

If you’re over 50, don’t forget catch-up contributions. They sit on top of the $23,500 cap and need their own tracking.

Why chase numbers when tech can do it for you?

With these safeguards, you’ll always get a heads-up before any cap stops your employer match. Enjoy your fully funded retirement savings, without the last-minute scramble!

Deciding between pre tax and Roth 401(k) contributions isn’t just ticking a box on your benefits portal. It’s about timing your tax savings, aligning with your long-term goals, and grabbing every dollar of your employer match. Let’s break down the real differences and walk through actionable tips so you don’t leave free money on the table.

Pre tax contributions lower your taxable income today. That’s extra cash in your pocket now, and it can feel like an instant win.

• You pay no federal or state income tax on the amount you defer

• Ideal if you’re in a higher current bracket than you expect in retirement

• Frees up dollars for short-term goals like paying down high-interest debt

Take Sarah, who’s in the 24% bracket this year but expects to drop to 12% in retirement. By diverting $1,000 pre tax, she saves $240 on her tax bill right away. Her employer match lands in her account untouched, so she doesn’t have to pick anything different for company contributions.

“Pre tax contributions can be a powerful tool if you value upfront tax relief.”

Roth 401(k) uses after-tax dollars. You pay tax now so you can enjoy tax-free growth and withdrawals later.

• Contributions and earnings come out tax-free after age 59½

• No Required Minimum Distributions (RMDs) during your lifetime

• Perfect if you expect your future tax rate to climb

Alex plans to pick up freelance work in retirement and figures his bracket could go from 22% today to 28% later. Locking in Roth now means no wrestling with bigger tax bills down the road.

“Tax-free withdrawals give you maximum flexibility to manage your retirement income.”

Below is a side-by-side look at how each option handles taxes and distributions.

| Feature | Pre Tax 401k | Roth 401k |

|---|---|---|

| Tax Deduction At Contribution | Yes | No |

| Tax On Withdrawals | Ordinary Income Tax Rate | Tax Free After Age 59½ |

| Required Minimum Distributions | Yes By Age 73 | No During Lifetime |

| Ideal For | Higher Current Bracket | Higher Future Bracket |

This quick comparison helps you spot which approach fits your current tax situation and retirement vision. Use it as a cheat sheet when you update your deferral elections.

Mixing both types can smooth out tax swings over decades. A simple hack is to split based on the gap between today’s bracket and your expected retirement bracket.

Case Study

Jamie divides her 6% deferral into 4% pre tax and 2% Roth to mirror her tax-rate estimate. That way, she captures immediate savings and locks in some tax-free growth.

For more on long-term retirement planning, see Effectively Planning For Retirement In Your 30s.

Start by estimating your current and future tax rates. Then split contributions to match that difference within your employer’s match ceiling.

Adjust these percentages if your plan’s match formula caps deferrals at a lower rate. This method ensures you capture every match dollar while balancing tax exposure.

Lock in your chosen mix before the next pay cycle so you don’t miss out on free employer contributions.

Tiny tweaks today can add up to thousands in extra retirement savings later.

By weighing the pros and cons of pre tax versus Roth, using our comparison table, and following these action points, you’ll be on track to max your employer match and fine-tune your tax strategy for the long haul.

You rarely see the same take-home each pay period. Whether life throws you a mid-year raise or a surprise side-gig payoff, your 401(k) strategy needs to bend with your income. Little tweaks today can snag every matching dollar.

Updating your deferral after a salary bump or a lump-sum bonus is easier than it sounds. First, hop into your plan portal and note your year-to-date deferrals.

Next, divide your remaining contribution goal by how many paychecks you’ve got left this year. That gives you the new deferral percentage to enter.

Finally, submit the new rate through your payroll system, ideally before your next pay date, to make every check count.

Staying proactive here makes sure you don’t miss an employer match.

Alex, a freelance graphic designer, saw his monthly income jump from $3,000 to $7,000 and back again. Instead of guessing each paycheck, he averaged his earnings over three months to pick a steady base deferral.

He landed on 6%, safely under the IRS limit, then treated any bonus as a catch-up opportunity by deferring extra in a single pay period. That way, he never overshot his annual max—and he captured every matching dollar.

| Month | Income | Deferral Rate | Match Captured |

|---|---|---|---|

| January | $5,000 | 6% | $180 |

| February | $3,000 | 6% | $108 |

| March | $7,000 | 6% | $252 |

| Bonus | $4,000 | 40% | $240 |

Once you hit 50, the IRS lets you add catch-up contributions on top of the standard limit. That extra cushion is a lifesaver when income spikes mid-year.

For one-off windfalls like bonuses, commissions, or tax refunds, think about a lump-sum deferral to bridge any gap.

Catch-ups and lump sums keep your retirement savings on track, even when income swings.

Think of your spreadsheet as your personal savings coach. By averaging past paychecks and projecting future matches, you catch dips before they become an issue.

Chart columns for pay dates, projected income, deferral percentage, and match amount. Use a rolling average formula like =SUM(deferrals)/COUNT(paychecks) to keep your percentages in line. Then plot your savings curve, so dips and spikes jump off the graph.

“Treat your spreadsheet like a coach cheering you on,” says Coach Hill at Financial Footwork.

Little adjustments now prevent big gaps later and guarantee you snag that free money.

Treat pay dates and rate changes like appointments, and set calendar reminders on your phone.

Scan your YTD deferrals and total contributions at least once a month so you don’t bust IRS or plan caps.

Switching companies mid-year can disrupt your match momentum, but most plans offer a true-up at year end to settle any shortfall.

Before you hand in your notice, ask HR about your vesting status and true-up schedule. Once you start the new gig, update your deferral percentage right away.

Transition events are just another variable you can master and turn to your advantage.

Small, timely adjustments make sure no free money slips through the cracks.

If you’ve ever wondered how to squeeze every dollar from your employer’s 401(k) match, you’re not alone. These quick-fire answers tackle the biggest questions and point you to next steps.

Yes, most 401(k) plans let you adjust contribution percentages anytime. If you slip below the match threshold on one paycheck, bump up your rate on the next.

• Double-check your plan portal after any change

• Watch for processing delays—some employers apply matches quarterly

• Set calendar reminders to review deferrals every two months

“A quick portal check after rate changes prevents surprises in your employer match.”

Leaving your company early can put unvested dollars at risk. Your summary plan description spells out if you’re on cliff vesting or graded vesting.

• Review the vesting chart in your plan document

• Count your service months—an extra 30 days could unlock more match

• Stay close to any milestone if you’re nearing a vesting cliff

Knowing exactly where you stand on vesting can save you from forfeiting free money.

If you’re 50 or older, catch-up contributions raise your personal limit, but they don’t change how your employer calculates matches. That means:

• Prioritize contributions up to your match threshold first

• Layer in catch-up dollars once you’ve secured the full employer match

• Keep an eye on your year-to-date totals to avoid surprise limits

Mixing pre-tax and Roth contributions won’t boost your match, since it’s based on your total deferrals no matter the tax treatment. Here’s a simple way to keep things on track:

• Lock in your match percentage before adjusting tax buckets

• Review your pay schedule each quarter for any shifts

• Capture screenshots of your plan portal to document changes

Make sure you secure the full match before messing with the tax mix.

Equip your team with financial coaching and boost engagement. Explore Financial Footwork for hands-on workshops, one-on-one sessions, and impactful curricula at https://financialfootwork.com today.

Hillary Seiler

Learn MoreCertified Financial Educator, Speaker, Author, & Personal Finance Expert | Helping businesses, pro sports organizations, and universities thrive with Financial Wellness Programs designed to boost growth and success.

by Hillary Seiler February 25, 2026 4 min read

Read More

by Hillary Seiler February 14, 2026 13 min read

by Hillary Seiler February 12, 2026 16 min read