Your Cart is Empty

by Hillary Seiler January 06, 2026 17 min read

When you inherit money, the weight of it all can be a lot. The emotions, the responsibility, the sudden pressure can feel overwhelming. The single most important thing to do first? Absolutely nothing.

Seriously. Just pause.

Receiving an inheritance is a major life event, often tangled up with grief and loss. The urge to "do something smart" with the money can feel immediate and intense, but making big financial decisions while you're navigating a tough emotional time is a recipe for regret.

Give yourself some breathing room. This isn't about putting things off; it's about being intentional. You need a clear head to make sound decisions, and that rarely happens overnight. Let the initial wave of emotions settle first.

This quick guide outlines the essential first steps to take after receiving an inheritance. Following these actions will help ensure you're protected and organized from day one.

| Action Item | Why It Matters | Who Can Help |

|---|---|---|

| Pause and Grieve | Rushing into decisions while emotional can lead to costly mistakes. | A grief counselor, trusted friends, family. |

| Secure the Funds | Park the money in a safe, separate account to avoid accidental spending. | A federally insured bank (look for FDIC or NCUA). |

| Gather All Documents | Organizing paperwork now prevents major headaches later. | An estate attorney can help identify what you need. |

| Assemble Your Team | You don't have to navigate this alone. Expert guidance is crucial. | A fee-only financial advisor, CPA, and estate attorney. |

| Understand the Process | Get a handle on legal steps like probate to set realistic expectations. | Your estate attorney is the best source for this. |

By focusing on these foundational steps, you build a solid base for making thoughtful, long-term decisions that honor the legacy you've received.

Before you do anything else, the money needs a safe place to land. Don't just drop a large sum into your regular checking account where it can get mixed in with your daily coffee budget.

Open a separate, high-yield savings account at an FDIC-insured bank. This move is simple but powerful. First, your money is protected up to $250,000. Second, it immediately starts earning a bit of interest without being exposed to market risk. Think of it as a secure holding pen while you map out your next moves.

Next up is the less glamorous but totally necessary task: paperwork. You need to get all the key documents in one place. This usually includes the will, trust documents, death certificate, life insurance policies, and any relevant account statements.

Create a dedicated folder, physical or digital, and keep everything together. Staying organized now will save you a world of frustration later. You'll likely encounter legal processes like probate, and understanding the probate timeline can help you manage expectations from the start. This is about setting up your command center before you decide on the mission.

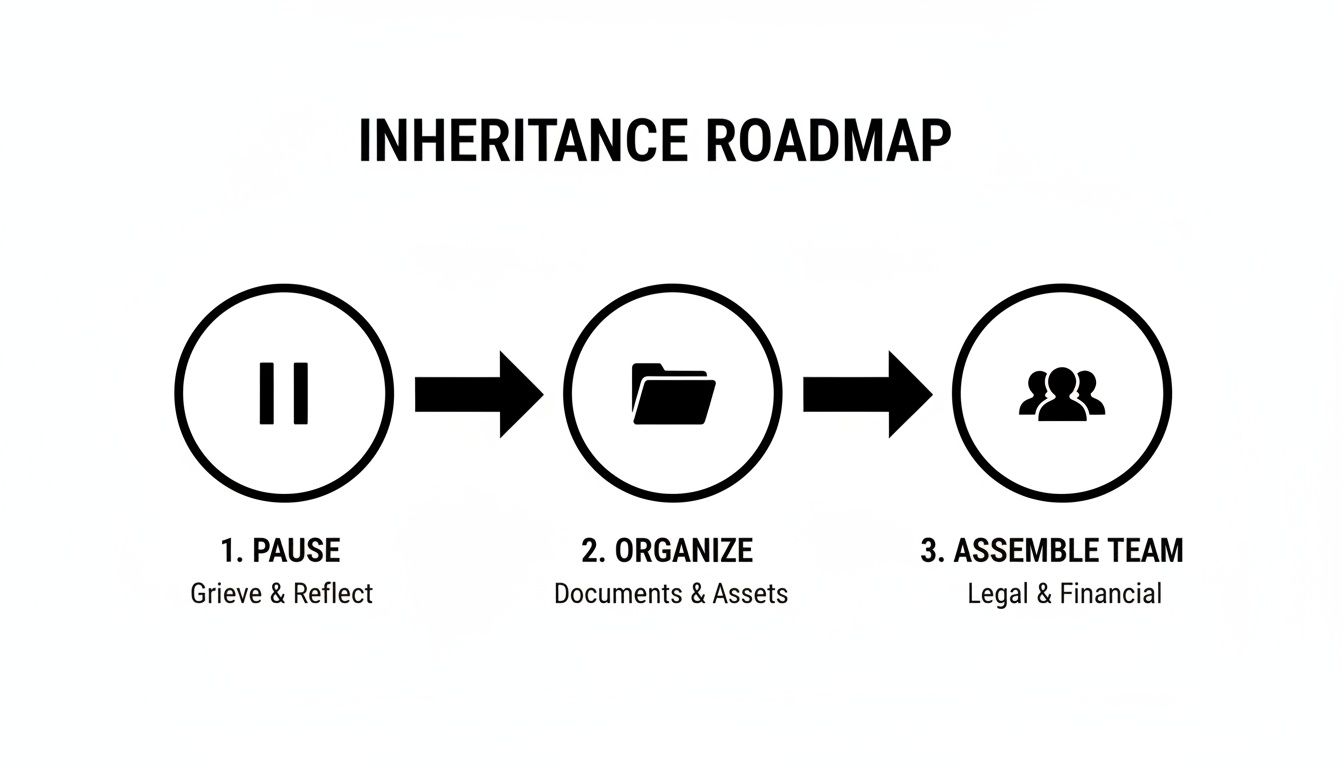

This simple roadmap visualizes the first few crucial steps after inheriting money.

This flow gets it right. Pausing, organizing, and building a team are the foundational actions that set you up for success.

You don't have to figure this all out by yourself. In fact, you shouldn't. One of the smartest investments you can make right now is building a team of trusted professionals.

Your core team should include:

Your immediate goal isn't to get rich quick. It's to protect the assets, understand your new financial picture, and create a thoughtful plan for the future.

History shows that without a smart plan, inherited wealth can vanish. Statistics reveal a stark reality: about 70% of inherited wealth is gone by the second generation, and 90% by the third, often due to poor financial decisions.

By taking these initial, deliberate steps, you're doing more than just managing money. You're building a foundation for long-term security and honoring the legacy you've been given.

Alright, you've taken that crucial first step to pause and get your head straight. Now it's time to put that money to work, starting with defense. The mission here is to secure the funds and immediately go on the attack against your most expensive debts.

This isn’t about flashy investments or big, risky moves. It’s about building a solid, stress-free foundation so you can make clear-headed decisions about your long-term goals later on. Let's get into it.

Before you even think about investing, you need to take a hard look at any high-interest debt you’re carrying. I’m talking about credit cards, payday loans, or personal loans with those brutal double-digit interest rates. That stuff is a financial anchor, dragging you down every single month.

Think about it this way: paying off a credit card with a 22% APR is like getting a guaranteed 22% return on your money. You simply can’t find that kind of guaranteed, risk-free return anywhere in the stock market. It's the biggest and most immediate win you can score with your inheritance.

This single move frees up your monthly cash flow, slashes financial stress, and instantly improves your financial health. Studies have shown that making a plan to wipe out high-interest debt first can preserve 20-30% more of your wealth in the long run.

So, how do you decide which debts to tackle first? The strategy is simple: go after the debt with the highest interest rate. This is often called the debt avalanche method.

Here’s a quick breakdown:

This method saves you the most money in interest over time, period. If you’re looking for a different approach that focuses more on building psychological momentum, you might also be interested in our guide on the debt snowball method.

After you’ve wiped out that high-interest debt, you'll likely have money left over. The big question is, where do you put it while you figure out your next moves? Your regular checking account is not the answer. It’s too easy to spend and earns basically nothing in interest.

You need a spot that’s safe, accessible, and actually earns you a little something.

Your goal for this money right now is capital preservation, not aggressive growth. Keep it liquid and safe from market swings while you finalize your long-term financial plan.

A high-yield savings account (HYSA) is almost always the best option. These are FDIC-insured online savings accounts that offer interest rates significantly higher than what you’d get at a traditional bank. Your money is safe, you can get to it if you need it, and it's still growing.

Other solid short-term options include:

By securing your funds and eliminating costly debt, you’ve built a strong financial base. You've turned a portion of your inheritance into immediate financial freedom and peace of mind, setting you up perfectly for the next phase: planning and investing for the future.

Now that you've dealt with the high-interest debt monster and parked your cash somewhere safe, it’s time for the fun part. This is where you get to dream a little and think about what you actually want your life to look like. A financial plan isn't about boring spreadsheets; it's about giving your money a job that moves you closer to the life you want.

So, what does that life look like? Is it buying a house so you can finally paint the walls whatever color you want? Is it traveling the world for a year? Maybe it’s the freedom to quit a job you hate and start that business you've been brainstorming for ages.

Get specific. Writing down your goals makes them feel real and gives you something to aim for. A vague goal like "be rich" is useless. But "have a $50,000 down payment for a house in three years"? That’s a target you can actually hit.

Once you know what you're aiming for, you can start talking about investing. For a lot of people, the word "investing" sounds intimidating, like it's reserved for Wall Street pros. It's not. Investing is just making your money work for you so it can grow over time.

The most important concept to get your head around is diversification. You've probably heard the saying, "don't put all your eggs in one basket," and that's exactly what this is. If you dump your entire inheritance into a single stock and that company tanks, you could lose everything. That’s a terrible plan.

Instead, you spread your money across a bunch of different investments. That way, if one part of your portfolio is having a bad day, the others can help balance things out. It’s all about playing the long game and protecting your wealth from big, sudden drops.

You don't need to be a stock-picking genius to be a successful investor. In fact, some of the best strategies are the simplest. For most people just starting out, a mix of index funds and ETFs is a fantastic way to build a diversified portfolio without all the stress.

These options are low-cost, automatically diversified, and have a proven track record of building wealth over the long haul. They are the perfect tool for turning your inheritance into a powerful engine for your future.

The goal isn’t to get rich overnight. It’s to build sustainable, long-term wealth that aligns with your life goals. Slow and steady really does win the race here.

For a deeper dive into getting your finances organized for these next steps, check out our practical advice on how to start saving money.

Deciding where to put your money can feel overwhelming, so let's break down some common choices. This table gives you a quick snapshot of different investment options to help you see how they stack up based on your goals and comfort with risk.

| Investment Type | Best For | Typical Risk Level | Example |

|---|---|---|---|

| High-Yield Savings | Short-term goals (1-3 years), emergency funds | Very Low | Parking your house down payment money while you search. |

| Stocks | Long-term growth, higher risk tolerance | High | Buying shares of a company like Apple or Tesla. |

| Bonds | Income generation, portfolio stability | Low to Medium | Loaning money to a government or corporation for interest. |

| Index Funds/ETFs | Diversified, long-term wealth building, hands-off investors | Medium | An S&P 500 ETF that tracks the 500 largest U.S. companies. |

| Real Estate | Generating rental income, long-term appreciation | High | Buying a rental property or investing in a REIT. |

No single option is perfect for everyone. The best strategy is often a mix of these, tailored to your specific timeline and what you want to achieve.

One of the absolute best things you can do with inheritance money is to get serious about your retirement. Tax-advantaged accounts like a Roth IRA or a 401(k) are like investing with a cheat code. The government literally gives you huge tax breaks to encourage you to save for your future.

Here’s a quick rundown:

Using some of your inheritance to max out these accounts each year is a game-changer. It puts your retirement savings on autopilot and lets the magic of compound interest do its thing for decades. Data shows that retirement accounts like IRAs and 401(k)s currently hold a staggering $31 trillion in assets, highlighting just how powerful these tools are. For more insights on global wealth trends, you can explore the full report on investor behavior from UBS.com.

By setting clear goals and using simple, effective investment tools, you’re not just spending your inheritance. You’re transforming it into a foundation for the rest of your life.

Making money is one thing; keeping it is a completely different ballgame. Now that you've started building a solid financial foundation and have an investment plan in the works, it's time to shift your mindset from offense to defense.

This is all about protecting your new wealth from taxes, legal headaches, and whatever surprises life decides to throw your way. Let's get into the real "adulting" stuff that secures your future.

Estate planning sounds like something reserved for the old and ultra-rich, but it's not. If you have assets like a house, investments, or even just a savings account, you need a plan. It’s basically just creating a clear rulebook for your money so there are no questions about your wishes down the road.

Getting this sorted out now is a massive gift to your loved ones. It saves them a ton of stress, confusion, and potential family drama during an already tough time. For long-term financial security, exploring different estate planning strategies, such as understanding various strategies to avoid probate in Texas, is key to making the process smoother for your family.

Here are the absolute must-haves for your plan:

Taxes are a fact of life, but that doesn’t mean you should pay more than you absolutely have to. With more assets to your name, being smart about taxes can make a huge difference in how fast your wealth grows. The goal here is to legally minimize what you owe the government each year.

One common strategy investors use is tax-loss harvesting. If you have an investment that's lost value, you can sell it to "realize" the loss. You can then use that loss to offset any capital gains you have from your winning investments, which lowers your overall tax bill. It's a way to find a silver lining in a down market.

Another key move is to max out your tax-advantaged accounts first, like your 401(k) and Roth IRA, before piling more money into a regular brokerage account. The tax breaks you get from these accounts are too good to pass up.

Think of your financial plan like a garden. Estate planning is the fence that protects it, and smart tax strategies are the weeding that helps everything grow stronger. You need both to thrive.

Insurance is the ultimate defensive play. It's the safety net that catches you when something unexpected happens, preventing a single bad event from wiping out years of hard work and smart planning.

With new wealth comes new things to protect. It's the perfect time to review your current insurance coverage and see if it still makes sense for your new reality.

Key Insurance to Review

| Insurance Type | Why It's Important Now |

|---|---|

| Life Insurance | If people depend on your income, this provides for them if you're gone. A larger net worth might mean you need a larger policy to cover everything. |

| Disability Insurance | This protects your greatest asset: your ability to earn an income. If you get sick or injured and can't work, this replaces a portion of your paycheck. |

| Umbrella Insurance | This is extra liability coverage that kicks in when your other policies (like auto or home) are maxed out. It’s a surprisingly inexpensive way to protect your assets from a lawsuit. |

Globally, a massive transfer of wealth is happening, with women set to control an additional $9 trillion through spousal transfers. This shift is also changing investment priorities. For instance, a staggering 90% of millennials now want their investments to have a positive environmental impact, a trend that is reshaping how wealth is managed and grown for future generations.

You can discover more insights about these global wealth trends on UBS.com. Thinking about these long-term trends can and should influence your financial protection strategy, too.

An inheritance is never a one-size-fits-all situation. How you should handle the money really depends on where you are in life. A twenty-year-old college student has entirely different priorities than a forty-year-old juggling a mortgage and kids.

Let’s be real. The advice that works for your parents might not work for you. So, let's break down some specific, actionable game plans tailored to your unique life stage.

If you’re already in the workforce, an inheritance can feel like hitting the fast-forward button on your financial goals. It’s a chance to build a level of security that might have felt years away. Suddenly, goals that seemed distant are right within your grasp.

This is your opportunity to finally get ahead. Think about maxing out your 401(k) for the year, especially if it means capturing the full employer match, to seriously supercharge your retirement savings. You could also fully fund a Roth IRA, which is a massive win for your future self.

Or maybe the best move is wiping out nagging debts like student loans or a car payment. Getting rid of those monthly bills frees up your income and gives you so much more breathing room. This windfall could also be the key to building a six-month emergency fund, which is the ultimate stress reducer.

If you're an athlete, especially one managing NIL deals or a new pro contract, a lump sum of money requires a special playbook. Your income is often unpredictable and your career timeline is shorter than most, so every financial decision carries more weight. It’s all about balancing the awesome opportunities you have right now with setting yourself up for life after the game.

The temptation to upgrade your lifestyle fast is huge, but the smartest athletes play the long game. The key is building a team of trusted pros who get the sports world. This isn't just a financial advisor, but someone who understands variable income, high tax brackets, and planning for a future that might not include a paycheck from your sport.

Your game plan should focus on a few key areas:

Receiving an inheritance as a student is an incredible head start, but it also comes with unique pressures. It can be tempting to use the money for spring break or a new car, but a little discipline now can literally change the entire course of your financial life.

Think about it this way: you have a superpower that most people don't get until much later in life, which is time. Using this money to start investing early unleashes the power of compound interest, letting your money work for you for decades to come.

"A financial windfall early in life is a massive opportunity. The goal isn't just to graduate without debt, but to graduate with assets already growing for your future."

This money is your ticket to graduating debt-free, which is a freedom most of your peers won't have. It could also become the down payment on your first home a few years after graduation. It's about making choices that your future self will thank you for.

No matter your life stage, figuring out what to do with inheritance money can feel like a lot. With an estimated $83 trillion expected to be transferred between generations in the coming years, more and more people will be in your shoes. Seeking guidance isn't a sign of weakness; it's the smartest move you can make. You can read more about this massive wealth transfer from a UBS.com report.

This is the perfect time to bridge any knowledge gaps you might have about personal finance. If you're wondering about the benefits of getting personalized help, you can learn more about what financial coaching is and how it can provide a clear roadmap. Professional guidance can turn an inheritance from a temporary windfall into lasting security.

Getting a sudden windfall of cash brings up a ton of questions. It's completely normal to feel a bit lost or overwhelmed. We've pulled together some of the most common things people wonder about when they're figuring out what to do with an inheritance, so you can get clear, straightforward answers.

This is the big one everyone asks, and the answer is usually a relief. In most cases, you personally don't pay federal taxes on the money you inherit. That tax, known as an estate tax, is handled by the estate of the person who passed away before you ever see a dime.

However, a few states do have their own separate inheritance tax. It’s critical to check the specific laws where you and the deceased lived. On top of that, if you inherit something like a traditional IRA or 401(k), you will have to pay income tax on that money when you start taking withdrawals.

The takeaway: While you likely won't face a federal inheritance tax bill, state taxes and taxes on retirement accounts can still apply. Always chat with a tax pro to be sure.

Honestly, you should move as slowly as possible. The single biggest mistake people make is rushing into huge financial decisions while they're still emotional. There's no prize for speed here, and a hasty move now could cost you big time later.

Give yourself a "cooling off" period of at least a few months, maybe even up to a year. Park the money in a safe, boring high-yield savings account where it's earning some interest but isn't mixed in with your everyday spending money. This buffer gives you time to grieve, think clearly, and build a solid plan with a trusted financial coach or advisor.

This is a personal call, but being discreet is often the smartest play. Money can change relationships in weird and unexpected ways. Suddenly, everyone becomes a financial expert giving you unsolicited advice, or you might start getting requests for "loans" from people you haven't heard from in years.

It’s often best to only discuss the nitty-gritty details with your partner and the financial professionals you’ve hired. You can absolutely be generous with loved ones if that's part of your plan, but do it on your own terms, not because you feel pressured. Protecting your privacy is a key part of protecting your newfound wealth.

Great question. Think of it like this:

For an inheritance, you might start with a coach to build your confidence and map out a game plan. Then, you could bring in an advisor to help execute the specific investment strategy you created together. They play different but equally important roles on your team.

Navigating an inheritance is a journey, but you don't have to do it alone. At Financial Footwork, we specialize in providing clear, practical financial coaching to help you make confident decisions that turn your inheritance into lasting security. Learn how our coaching can build your financial confidence.

Hillary Seiler

Learn MoreCertified Financial Educator, Speaker, Author, & Personal Finance Expert | Helping businesses, pro sports organizations, and universities thrive with Financial Wellness Programs designed to boost growth and success.

by Hillary Seiler February 25, 2026 4 min read

Read More

by Hillary Seiler February 14, 2026 13 min read

by Hillary Seiler February 12, 2026 16 min read